EUR/USD moved by the drum of Draghi in a very exciting week: the wide array of measures was not enough to counter the end of new stimulus, at least for now. What’s next? Inflation data stands out this week. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The ECB met market expectations with a cut of the deposit rate by 10bp to -0.40% but certainly went further with a cut of the lending rate to 0%, an expansion of QE by €20 billion to €80 billion, new TLTROs and more lax bond buying rules. A drop of around 150 pips in EUR/USD lasted only an hour when he said that there is no need for further action and EUR/USD shot up, eventually ending the week on a higher footing. Was it a short squeeze? Will markets realize that the stimulus package was huge? Or have markets lost faith in the power of the ECB and central banks in general?

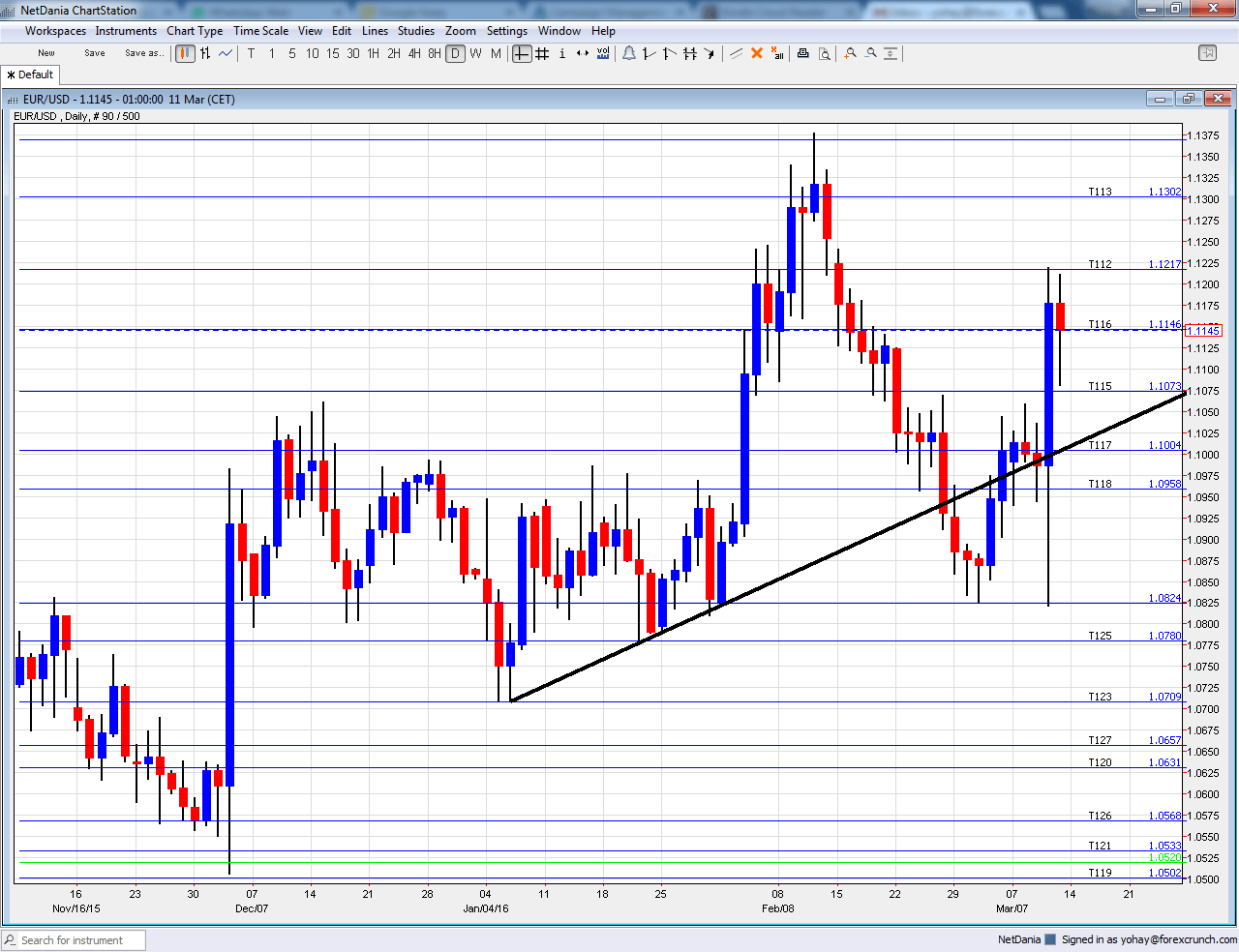

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Industrial Production: Monday, 10:00 .Euro-zone industrial output dropped by 1% in December in a disappointing outcome. After Germany’s surprisingly strong figure for January, a bounce is also on the cards for the all-European figure now: 1.7% is predicted.

- French Final CPI: Tuesday, 7:45. Prices in the second largest economy rose by 0.2%. This number will likely be confirmed now.

- Employment Change: Tuesday, 10:00. While the figure is lagging (it is for Q4) it still provides a wide view on the labor market situation. A rise of 0.3% was recorded in Q3. Another rise is on the cards now: 0.2% for Q4.

- CPI: Thursday, 10:00. According to the initial release, prices dropped 0.2% y/y in the headline figure and rose only 0.7% in core inflation. This certainly had its impact on the ECB. A confirmation is expected now. While the ECB decision is already behind us, a deterioration in inflation could open the door for more action, contradicting Draghi’s words.

- Trade Balance: Thursday, 10:00. Germany’s exports keep the euro bid with a positive trade balance. After +21 billion in December, a similar number is on the cards for January. A surplus of 20.2 billion is expected.

- German PPI: Friday, 7:00. Producer prices have fallen for quite some time. A drop of 0.7% was recorded last time, and yet another drop is likely now: -0.2%.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar flirted with the 1.10 level mentioned last week. It then dropped to the 1.0820 level and from there it went all the way up to 1.1220, very nice technical behavior, before settling on lower ground.

Technical lines from top to bottom:

We start from higher ground this time: 1.1460 was a key resistance line in 2015 and 1000 above the multi-year lows. 1.1373 is a veteran line from 2003 that continued playing a role also in 2015.

1.13 worked as support back in October and is the high line at the moment. It is followed by the swing low of 1.1220 in September which is minor resistance now.

1.1140 cushioned the pair in October. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which worked in the past as resistance, provided a cushion for the pair in February. 1.0825 worked as support in early March 2015 and should also be watched. This is now a triple bottom.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015. 1.0630 worked as nice support in November 2015 and then switched to resistance.

I am neutral on EUR/USD

The reaction to Draghi’s huge announcement was certainly not the expected one. Even if more stimulus is unlikely, the effect of the measures announced should keep the euro rally limited. In addition, we could always hear more action could come if things deteriorate, something we also heard in the presser. In the US, the Fed will try not to rock the boat and this could also stabilize the pair. This doesn’t mean no action, but all in all, the pair could close the week close to similar levels.

Our latest podcast is titled Digesting Draghi & Fired for the Fed