EUR/USD dropped for the third consecutive week as monetary easing from the ECB seems more real. European Parliamentary Elections, employment data, retail sales and a series of speeches from Draghi are the highlights of this week. Here is an outlook on the main market-movers coming our way. Here is an outlook on the highlights of this week and an updated technical analysis for EUR/USD.

German, French and Eurozone Manufacturing PMIs all softened in April failing to live up to market expectations. Another disappointment came from the German IFO Business Climate. The Euro-area recovery remains lukewarm and highly dependent on Germany’s strength. The pressure from the data was joined by incessant talk from ECB officials about action in June. It seems that a negative deposit rate could be joined by additional measures. In the US, the FOMC minutes did not consist of many surprises, yet the Fed already looks to the day that easing ends. Does the pair have more room to fall? Let’s start:

[do action=”autoupdate” tag=”EURUSDUpdate”/]

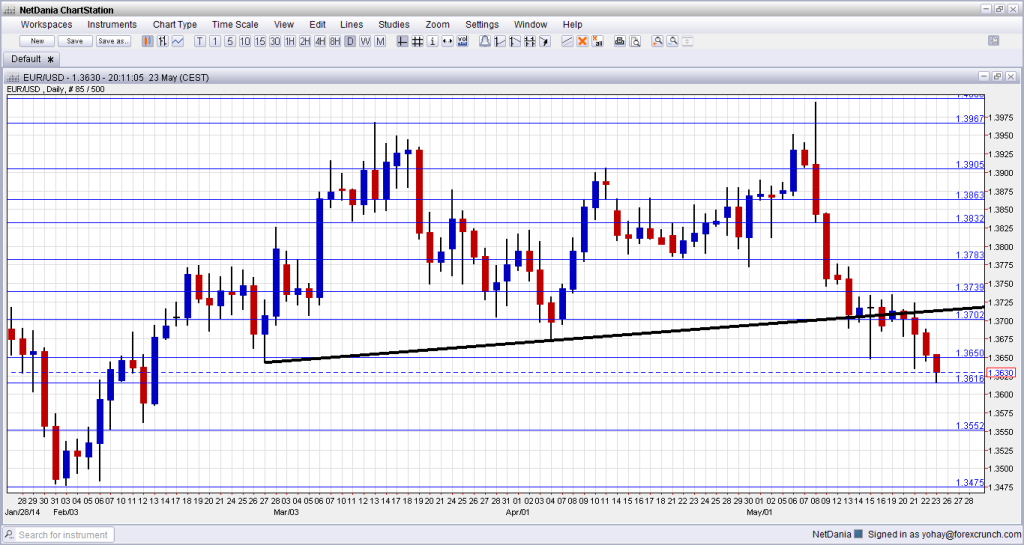

EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- European Parliamentary Elections: Sunday. The European Parliament elections takes place every five years. This time 751 MEPs will be elected and the voters will have more of a say in the appointment of the next Commission president. According to recent surveys, only 37 percent of Europeans believe their voice counts in Brussels. Policymakers in Brussels are trying to democratize the election process, and for the first time, the election results will be linked to the selection of the European Commission president. The major risk is that Euro-skeptic parties from the right will gain ground, thus undermining the decision making processes in the union.

- Mario Draghi speaks: Sun. 17:30, Monday, 8:00, Tuesday 13:30. ECB President Mario Draghi will speak in Sintra-Portugal at the ECB Forum on Central Banking. Issues such as inflation, the sluggish recovery and the ECB’s means of response may be raised in his speech. Market volatility is expected. His words about ECB action in June started the downfall of the euro that accompanies us in the past three weeks. While not every one of his appearances could consist of monetary policy related comments, there is a good chance he might say something to trigger action, a week before the big event.

- GfK German Consumer Climate: Wednesday, 6:00. German consumer sentiment remained elevated in April at 8.5 points, its highest level in more than seven years. However, consumers became more pessimistic about Germany’s economic outlook due to the ongoing crisis in Ukraine. The GfK consumer climate survey is an important tool to measure household finances in the coming 12 months. Consumer sentiment is expected to remain unchanged at 8.5.

- French Consumer Spending: Wednesday, 6:45. French consumer spending advanced in March by 0.4%, mainly due to increased household heating amid the unusually cold weather. Analysts expected a smaller rise of 0.3%. Nevertheless, this rise was not enough to stop a quarter-on-quarter decline. High unemployment rate lowers household spending, which accounts for over half of France’s output. The government expects that household consumption will increase by a mere 0.2% this year and contribute to keeping the economy’s head above water. Consumer spending is expected to increase by 0.5% this time.

- German Unemployment Change: Wednesday, 7:55. The number of jobless people in Germany decreased more than expected in March down by 25,000 to a seasonally adjusted 2.872 million. Analysts expected a smaller decline of 10,000. The growth trend in the German labor market will sustain growth and increasing domestic demand. Jobless claims are expected to decline further by 14,000.

- M3 Money Supply: Wednesday, 8:00. The euro zone’s M3 money supply increased less than expected in March, climbing 1.1% from 1.3% in February. Economists expected the money supply to grow by 1.4%. M3 money supply is predicted to advance 1.2%.

- Private Loans: Wednesday, 8:00. Loans to the Eurozone’s private sector declined for the 23rd consecutive month in March. Loans contracted 2.2% while expected to decline 2.0%. Private loans also declined 2.2% in February. The negative loan figures point to the weak state of the bloc’s recovery. ECB’s Draghi said that in case of worsening in the bank lending channel, the ECB would respond. Private loans are expected to drop by 2.1% this time.

- German Retail Sales: Friday, 6:00. Retail sales in Germany plunged 0.7% in March following a 0.4% gain in February, due to concerns over the Ukraine crisis. Analysts expected a smaller drop of 0.6%. Consumers are concerned that economic recovery could get weaker if Russia will respond to the sanctions imposed by the Euro members which will effect German exports. German retail sales are expected to advance 0.4% in April.

- Italian CPI: Wednesday, 9:00. Italian monthly inflation edged up 0.2% ub April, beating forecasts for a 0.1% rise and following a 0.1% gain in March. On a yearly base, Italy’s inflation rate increased from 0.4% in March to 0.6% in April, the first rise in 10 months, according to preliminary estimates. Mild price increases indicates that the recovery pace is still weak. CPI is expected to remain unchanged this time.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar kicked off the week with an attempt to reach the 1.3740 line (mentioned last week). However, this attempt failed and the pair began falling. At first, it found support at the 1.3650 line, but this gave way as well, and EUR/USD reached new 3 month lows.

Technical lines from top to bottom:

The all important round number of 1.40 is now even stronger after the pair was clearly rejected there in early May. Below, the 2014 high of 1.3964 will be closely watched.

The April peak of 1.3905 serves as minor resistance. It is followed by 1.3865 which capped the pair during the same time as well.

1.3830, which was a long serving 2013 peak comes back into the focus after capping the pair in March 2014 and serving as a clear separator several times. 1.3785 worked as support for the pair during April and served as resistance beforehand.

1.3740, which provided some support at the end of 2013 is now key support to the downside. The round number of 1.37, is another support line after capping the pair in December yet it is weakening.

1.3650 provided support in December and worked as resistance in September 2013, and is also a significant line, especially after the bounce in May. Also the February rally fell short of this line. 1.3615 is the new May 2014 low and it serves as the next line of support.

Below, 1.3560 worked as good support twice during February 2014. The January 2014 low of 1.3515 provides minor support on the way down. 1.3450 worked as resistance in August 2013 and as support in September and October. It is now a key line on the downside.

1.3475 worked as strong support back in February and previously worked in both directions. The round number of 1.34 was last seen in December as a stepping stone for the pair on its way down.

Broken uptrend support

The uptrend support line that accompanies the pair since late February has been finally broken after a battle. This serves as another downside hint.

I remain bearish on EUR/USD

The ECB is preparing action in June, and this is not fully priced into the value of the euro. The exchange rate is still high for the central bank and Draghi could certainly talk the euro further down. In addition, more downside risks come from the recent data: forward looking PMIs fail to impress, GDP is strong only in Germany, and business confidence in this big country also disappointed.

A rise of the euro-skeptics could also weigh on the common currency. Even if US Q1 GDP is revised to contraction, this is not likely to alter the path of the Fed. All in all, a fourth consecutive week of drops is more likely.

More EUR/USD:

- Forex Analysis: EUR/USD Weighed Down Below 200-Day Moving Average

- Could EURUSD Be The Trade Of The Year?

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast

- For the kiwi, see the NZDUSD forecast.