EUR/USD slid in range and lost the 1.30 line once again, as the debt crisis issues saw no progress, and as Germany looks weaker. President Draghi’s speech German retail sales and a meeting of the Eurogroup are the major events this week. Here is an outlook on the market-movers ahead.

Further EU weak data was released last week indicating a continued slowdown in the eurozone with lower than expected Flash PMI’s; Eurozone Flash manufacturing PMI falls from 46.1 to 45.3, while services remained almost unchanged. The biggest worries surround Germany, that saw a significant drop in its manufacturing PMI to 45.7 and a drop in economic sentiment, as reported by IFO. Spain is still thinking what do regarding a bailout after mixed regional election results. With Greece, the deal is not done yet. All the options are on the table after Germany’s finance minister cast doubt over Greece’s euro-zone membership.

Updates: ECB President Mario Draghi addressed a banking forum in Frankfurt. Spanish Flash GDP posted its fourth consecutive decline, posting a drop of 0.3%. This was a notch better than the estimate of -0.4%. Weak German data continues to alarm the markets. German Unemployment Claims jumped by 20 thousand, the highest level since June 2009. Euro-zone Retail PMI fell in October, posting a reading of 45.3 points. The markets are waiting for the Italian 10-year Bond Auction later on Tuesday. The euro continues to edge higher, as EUR/USD was trading at 1.2950. The Italian 10-year Bond Auction was very successful, with yields falling to 4.92%. Germany finally posted some positive numbers, with Retail Sales jumping 1.5%. The estimate stood at 0.4%. French Consumer Spending rose a modest 0.1%, a notch below the forecast of 0.2%. The Italian Monthly Unemployment Rate came in at 10.8%, matching the forecast. European finance ministers met on Wednesday in Brussels, and reported good progress in talks between the troika and Greece. The French 10-y Bond Auction posted an average yield of 2.22%.Euro-zone CPI Flash Estimate rose 2.5%, matching the forecast. Euro-zone Unemployment Rate hit another dubious record, climbing to 11.6%. This was slightly above the estimate of 11.5%. Italian Preliminary CPI posted a flat 0.0%, below the estimate of 0.2%. The German 30-y Bond Auction posted a slightly higher yield, with an average of 2.34%. The euro has edged higher, as EUR/USD was trading at 1.2974. There are no Euro-zone releases scheduled on Thursday.

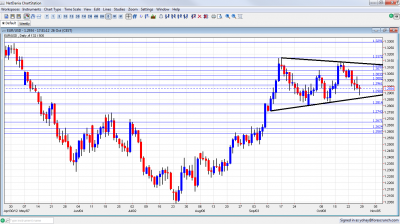

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Inflation data: Monday. German consumer prices remained unchanged over the previous month, in line with predictions, following a 0.4% increase in August. The lower reading in September reduced the annual headline inflation from 2.1% in August to 2.0% in September. A flat reading is expected now.

- Mario Draghi speaks: Tuesday, 8:00. Mario Draghi President of the ECB is scheduled to speak in Frankfurt at the Second Conference of the Macro-Prudential Research Network of the European System of Central Banks. He is likely to defended his bond-buying plan to ease the eurozone’s debt crisis. His speech can cause volatility in the market, especially if he clarifies his talk about the danger of deflation. Is a rate cut coming next week?

- Spanish Flash GDP: Tuesday, 8:00.Spain’ s economy slid further into recession in the second quarter contracting 0.4% following a 0.3% decline in the previous quarter, due to another round of austerity measured imposed by the government to deal with the growing budget crisis. Price hikes due to a 3-point rise in value-added tax lowered consumer spending even further in the last quarter. A drop of 0.4% is expected this time.

- German Unemployment Change; Tuesday, 8:55. German unemployment worsened for the sixth consecutive month in September with an addition of 9,000 people to the unemployment records, following the 11,000 increase in the preceding month. Weakening exports is the major cause for the deterioration inGermany’s labor market also lowering its growth prospects. Unemployment is expected to grow further in the next two months. A further increase of 10,000 job seekers is expected now.

- Retail PMI: Tuesday, 9:10. The Eurozone retail sector increased modestly to 47.1 from 44.4 in August, the highest reading since June, however on a yearly base, the Eurozone declined sharply in September leaving the retail sector in contraction.Germany is the only positive force among the three leading economies compared to the weakening in France and the sharp drops in Italy.

- Eurogroup Conference Call: Ministers of the euro-zone will speak about Greece and the ongoing negotiations between the EU / ECB / IMF troika and the debt struck country. Will decisions be made? We can assume that market moving statements will be made. In the meantime, the extreme right is gaining traction in Greece.

- German Retail Sales: Wednesday, 7:00. German retail sales increased 0.3% in August, lower than the 0.5% rise predicted, this modest grow bolstered hopes of escaping a further economic decline amid the global economic downturn. A rise of 0.6% is expected now.

- French Consumer Spending: Wednesday, 7:45. Consumer spending rose above predictions in July with a 0.4% climb, following an upwardly revised 0.4% increase in June. A rise of 0.2% is forecasted.

- CPI Flash Estimate: Wednesday, 10:00. Eurozone annual inflation is estimated to be 2.7% in September 2012, higher from 2.6% in August. The ECB target rate is below 2.0%.The main rises occurred in energy products, food, alcohol & tobacco as well as services. A rise of 2.5% is anticipated.

- Unemployment Rate: Wednesday, 10:00. The unemployment rate in the Eurozone reached 11.4% in August, following the same rate in June revised up from 11.3%, while the lowest rates were in Austria, Luxembourg, the Netherlands and Germany. No change is forecasted.

- Spanish, Italian and the Eurozone Manufacturing PMI: Friday, 8:15. Spanish Manufacturing PMI index increased to 44.5 in September following 44.0 in August. Despite the rise the reading indicates contraction. Meanwhile Italian manufacturing sector also improved to 45.7 following 43.6 in August, also suggesting a slowdown amid sharp price hikes spoiling companies’ efforts to promote sales. Italian PMI is expected to reach 45.9, while Eurozone at 45.3. The final manufacturing PMI will likely confirm the weak numbers reported in the initial release – a faster contraction, coming mainly form Germany.

*All times are GMT.

EUR/USD Technical Analysis

€/$ began the week with a failure to break above the 1.3075 line (mentioned last week). It then continued on a gradual path downwards, losing 1.30 and also temporarily dipping under 1.29.

Technical lines from top to bottom:

We start from lower ground this time. The round level of 1.34 is a strong cap after serving as such during March. 1.3290 worked as resistance for the pair during April and is also of importance.

1.3170 worked very well as a double top during September 2012 and is now the top frontier. A failure to tackle this line shows that the pair has limited momentum. 1.3105 provided some support in April and is a rather weak line at the moment.

1.3075 worked as a nice separator in mid October and also in September. 1.3030 provided some support at the same period of time. Both are minor in comparison with the next line.

The very round 1.30 line was a tough line of resistance for the September rally. In addition to being a round number, it also served as strong support. It is now becoming more pivotal and a battleground. It is closely followed by 1.2960 which provided some support at the beginning of the year and also in September and October.

1.29 is a round number that also provided support when the euro was tumbling down back in May. It is weaker now. 1.2814 was the peak of a recovery attempt in May and also capped the pair in September 2012. A slide lower in October 2012 almost met this line.

1.2750 capped the pair after the Greek elections and also had a similar role in the past. It is weaker now. 1.2670 was a double bottom during January and was the high line of the recovery before the Greek elections in June. It also capped the pair at the beginning of July 2012.

Narrowing Channel Forming

Both downtrend resistance and uptrend support were formed early in September. Uptrend support is more significant, and the pair is getting close to this line.

More technical analysis: EUR/USD Extends Bearish Retracement

I remain bearish on EUR/USD

The failure of the EU Summit was indeed felt in the value of the euro, but troubles are not over. Greece, where a deal seemed close, is not secure in the euro-zone after Wolfgang Schäuble, Germany’s finance minister, cast doubt on its membership. Is it a negotiation trick? Or have the Greeks reached their limits? Spain’s unemployment officially reached 25%, but as its funding needs are almost complete for the year, the government seems reluctant to ask for aid – a move the euro needs for a boost. And, the German locomotive has run out of steam as well, as forward looking data show.

In the US, things are getting slightly better, but as we’ve seen in the non event Fed decision, the big drama will probably wait for the elections, due in the following week.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD and more. Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast