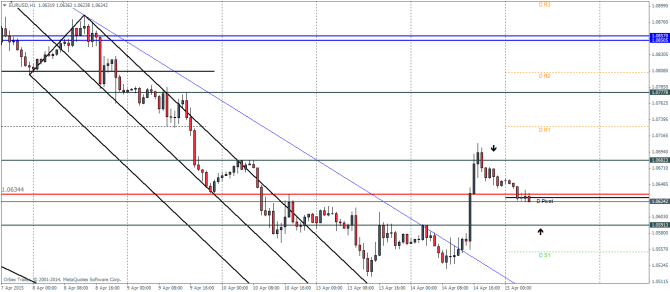

EURUSD Daily Pivots

| R3 | 1.0905 |

| R2 | 1.0806 |

| R1 | 1.0729 |

| Pivot | 1.0630 |

| S1 | 1.0553 |

| S2 | 1.0454 |

| S3 | 1.0377 |

EURUSD broke out from the falling median line and managed to rally above the previous short term resistance at 1.0591 level to briefly test 1.0634. Price action reversed from this level and is now trading just a few pips below 1.06344. We can expect the declines to hold near the next support at 1.05913, which could turn to be bullish for EURUSD, provided it manages to break through 1.06344 targeting the initial level at 1.068 and eventually 1.077. If the support at 1.05913 fails, EURUSD could see much sharper declines, targeting 1.05115 in the medium term.

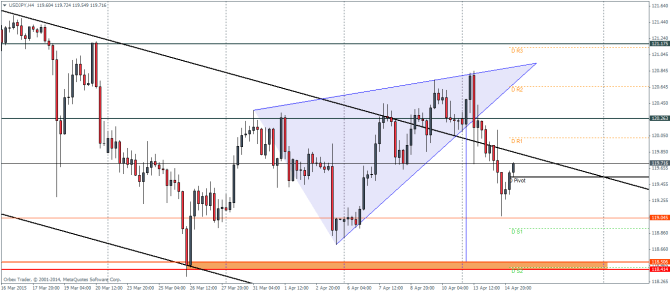

USDJPY Daily Pivots

| R3 | 121.131 |

| R2 | 120.656 |

| R1 | 120.024 |

| Pivot | 119.543 |

| S1 | 118.913 |

| S2 | 118.436 |

| S3 | 117.806 |

USDJPY broke out from the ascending triangle pattern near 120.26 and managed to move back lower into the falling price channel. Price action is currently showing a retracement and the initial level to watch for is 120.26. If this level holds, USDJPY could probably decline lower towards 119.045 and finally down to 118.506. However, is price breaks above 120.26, we could see USDJPY target 121.175 and also invalidate the ascending triangle pattern.

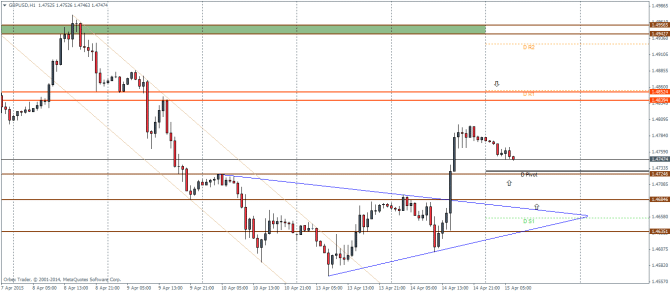

GBPUSD Daily Pivots

| R3 | 1.5053 |

| R2 | 1.4927 |

| R1 | 1.4854 |

| Pivot | 1.4724 |

| S1 | 1.4656 |

| S2 | 1.4531 |

| S3 | 1.4458 |

GBPUSD formed a longer term triangle consolidation pattern at the bottom and yesterday broke out to the upside from 1.4685 levels. Price action is looking to retest the lower levels now, either at 1.472 or the previous break out level at 1.4685. If any of these levels hold, GBPUSD could see a rally towards 1.485 – 1.483 in order to complete the measured move. Failure to hold the retest below 1.468 will be an indication of a failed triangle pattern which could see price dip lower targeting 1.4635.