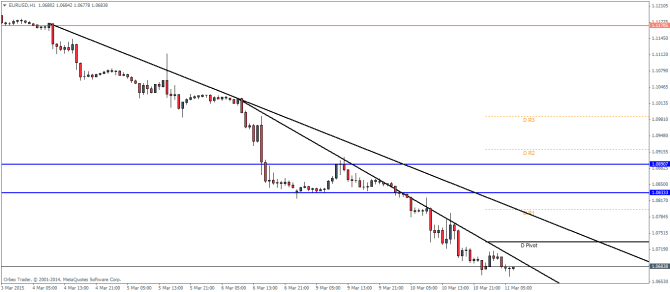

EURUSD Daily Pivots

| R3 | 1.0986 |

| R2 | 1.0920 |

| R1 | 1.0799 |

| Pivot | 1.0733 |

| S1 | 1.0612 |

| S2 | 1.0546 |

| S3 | 1.0425 |

EURUSD continues to weaken with every passing day showing no respite with little to none pullbacks in this downtrend. If this bearish momentum continues, EURUSD could likely target 1.05 levels quite easily. Any bounces are most likely to see a renewed bearish momentum pushing prices lower. For the moment, a minor base seems to have formed at the lows of 1.0678 and a break of this low could see more continued declines, while the trend lines could identify the corrective bounces.

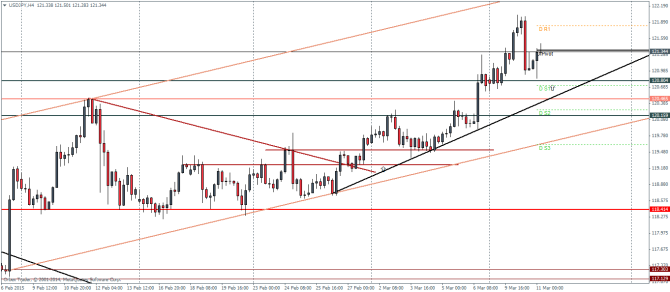

USDJPY Daily Pivots

| R3 | 122.928 |

| R2 | 122.478 |

| R1 | 121.822 |

| Pivot | 121.371 |

| S1 | 120.715 |

| S2 | 120.265 |

| S3 | 119.609 |

USDJPY briefly touched 122 yesterday and promptly dropped back lower. Short term support comes in at 120.8 followed by 120.5 and finally 120.16, where any of these levels could act as support, but do highlight the fact that the USDJPY is poised to gain to the upside. The minor trend line connecting the lows from late February through early March shows that the declines to the downside could be sharp or could also hint at a break of the minor trend line which will see a decline down to 120.465 levels.

GBPUSD Daily Pivots

| R3 | 1.5214 |

| R2 | 1.5171 |

| R1 | 1.5112 |

| Pivot | 1.5070 |

| S1 | 1.5011 |

| S2 | 1.4969 |

| S3 | 1.491 |

GBPUSD is now close to the lows of 1.4951, established on the 23rd of January. A dip to this low is very likely and could possibly turn critical for GBPUSD. A break below 1.4951 could see further declines in the Cable, while establishing support at this level could possibly put the brakes on the Cable’s declines for now. To the upside, the major resistance is at 1.523 through 1.54 which needs to be cleared for any meaningful gains. On the short term, price is reacting to the upper trend line of the price channel and the failure to break below the recent lows at 1.504 could mean a rally back to 1.52 to correct this steep decline.

In the fresh podcast, we talk about the US economy, the Australian and Canadian rate decisions, a potential easing in Japan, the widening gap within oil prices and an update on forex brokers after the SNBomb

Follow us on the iTunes page