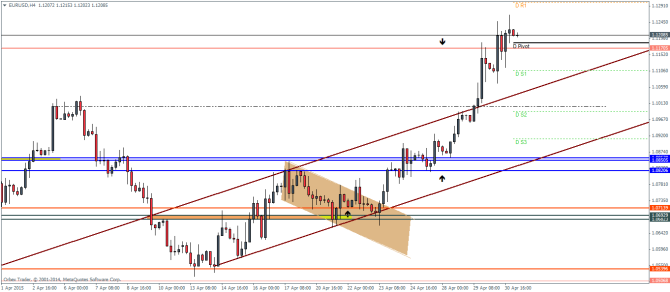

EURUSD Daily Pivots

| R3 | 1.1496 |

| R2 | 1.1379 |

| R1 | 1.1301 |

| Pivot | 1.1184 |

| S1 | 1.1107 |

| S2 | 1.099 |

| S3 | 1.0909 |

EURUSD has reached the target resistance/support level at 1.117 after briefly spiking to 1.125. A retest to 1.117, which if holds, could see a further push to the upside for EURUSD. However, the sharp rally in this currency is likely to pose risks for a correction to the downside. A break below 1.117 could see a decline to 1.1 levels. The daily charts continue to show a bullish candlestick formation which puts the bias to the upside with an eventual target to 1.12845.

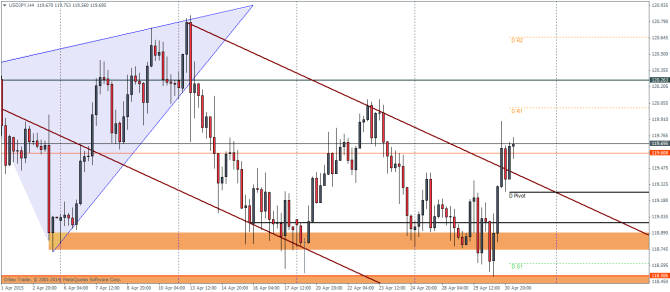

USDJPY Daily Pivots

| R3 | 121.409 |

| R2 | 120.646 |

| R1 | 120.01 |

| Pivot | 119.256 |

| S1 | 118.611 |

| S2 | 117.857 |

| S3 | 117.213 |

USDJPY made a brief test to 118.5 yesterday and reversed its losses. Price action has broken out from the falling price channel and we expect a small retest to the break out. To the upside, the initial target comes in at 120.26 – 120.25 levels. To the downside, the currency seems to be well supported near 119 levels and lower.

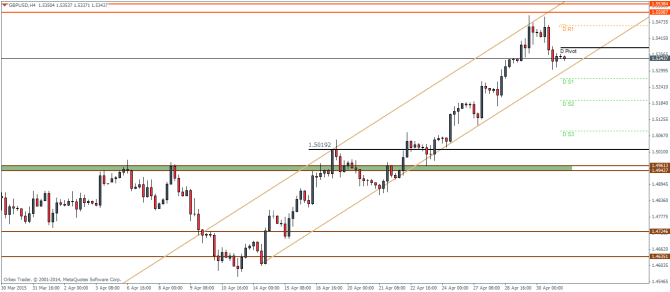

GBPUSD Daily Pivots

| R3 | 1.5649 |

| R2 | 1.5568 |

| R1 | 1.5459 |

| Pivot | 1.5381 |

| S1 | 1.5272 |

| S2 | 1.5192 |

| S3 | 1.5083 |

GBPUSD attempted to break above the previous highs at 1.546 but failed. The Cable reversed from these levels and is now trading at 1.53438. Price is still trading in the rising channel but a break out is starting to look increasingly possible. A break from the price channel will see price drop to test 1.501 and 1.50 levels of support.