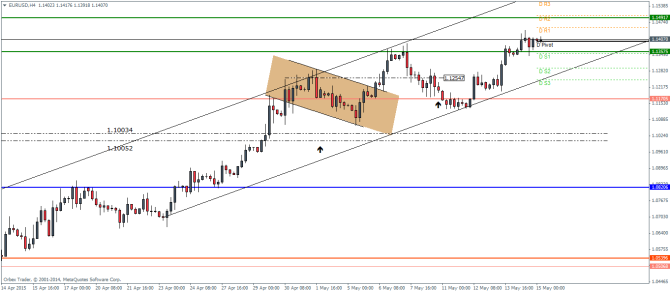

EURUSD Daily Pivots

| R3 | 1.1558 |

| R2 | 1.1501 |

| R1 | 1.1454 |

| Pivot | 1.1395 |

| S1 | 1.1349 |

| S2 | 1.1291 |

| S3 | 1.1245 |

EURUSD (1.1407): EURUSD is trading in a range this morning after making a high of 1.14438. The currency looks fairly supported near 1.13575 which marked a previous resistance level and one which is acting as support at the moment. From the daily charts, price action has moved higher after we identified the bullish engulfing candlestick pattern on the daily charts three days ago. To the upside, the next target is at 1.148. On the intraday chart, the bullish flag pattern’s target comes at 1.14917 and as long as support at 1.13575 holds, the upside projection is likely to be met.

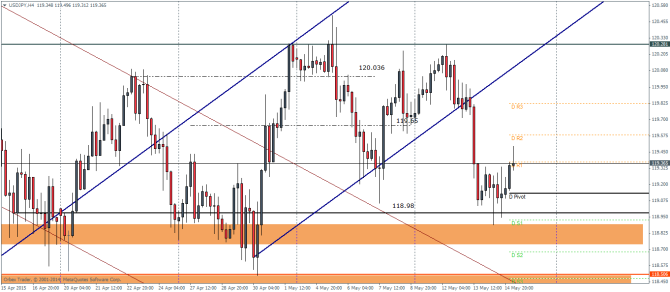

USDJPY Daily Pivots

| R3 | 119.825 |

| R2 | 119.577 |

| R1 | 119.375 |

| Pivot | 119.127 |

| S1 | 118.925 |

| S2 | 118.677 |

| S3 | 118.469 |

USDJPY (119.356): USDJPY has formed a doji candlestick pattern on the daily chart after two days of decline. Today’s price action will be important as a bullish close will see a move to the upside. From the intraday charts, price briefly touched the 118.98 support level and looks to be bouncing off from here. However, only a close above 119.65 will validate any further moves to the upside which comes in at 120.28 as the next level. But price could see a retest to the break out from the price channel near 119.820 price level.

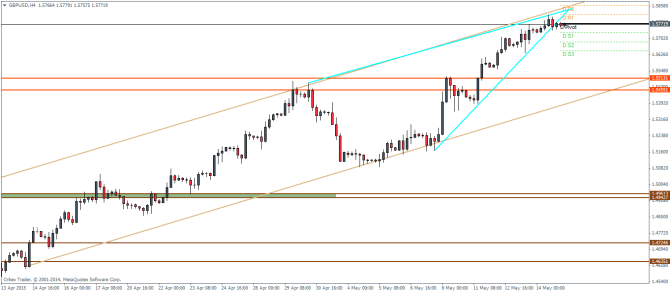

GBPUSD Daily Pivots

| R3 | 1.5902 |

| R2 | 1.5857 |

| R1 | 1.5815 |

| Pivot | 1.5773 |

| S1 | 1.5730 |

| S2 | 1.5685 |

| S3 | 1.5643 |

GBPUSD (1.5772): GBPUSD has broken above the previous target price point at 1.57525 and remains very bullish. However, the body (open/close) range seems to be getting smaller which could indicate to a possible correction or a consolidation in the rally. The next target is question is 1.59 from the daily charts. On the intraday time frame, price action looks to have been moving into a rising triangle/wedge pattern. This is indicative of a potential correction to this rally. As such, failure to post new highs above 1.5815 will see GBPUSD likely to decline in the short term to the support at 1.5513 through 1.5455.