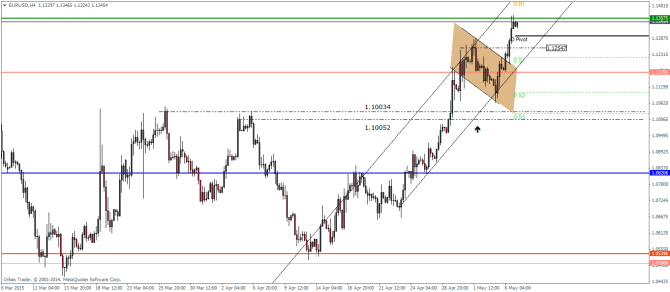

EURUSD Daily Pivots

| R3 | 1.1613 |

| R2 | 1.1491 |

| R1 | 1.1418 |

| Pivot | 1.1295 |

| S1 | 1.1221 |

| S2 | 1.1098 |

| S3 | 1.1026 |

EURUSD broke out from the bullish flag formation to rally towards 1.13575, the first price point that was identified. A break above this level is needed to see another continuation of the rally to 1.149 or 1.15 level. At risk is the fact that the price channel is looking rather steep and narrow. A break from the price channel could indicate a correction to 1.1 region which remains untested. In this view, the price at 1.1254 will be an important level to watch for.

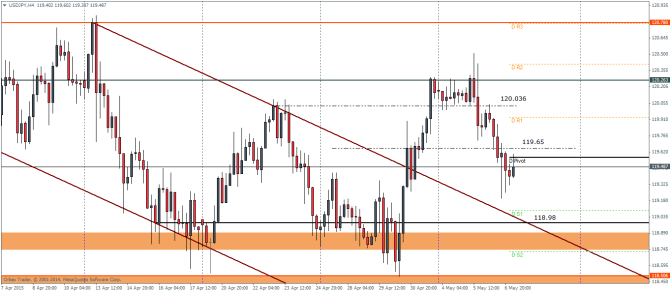

USDJPY Daily Pivots

| R3 | 120.77 |

| R2 | 120.412 |

| R1 | 119.933 |

| Pivot | 119.567 |

| S1 | 119.087 |

| S2 | 118.721 |

| S3 | 118.242 |

USDJPY saw a clear reversal, failing to break above 120.26 and broke down to 120.036 and eventually below 119.65. Price could see further declines with a possible retest to the upper rail of the falling price channel. Also, support comes in at 118.98 levels, which if holds could see another attempt to the upside with the previous levels to be cleared to see further upside gains.

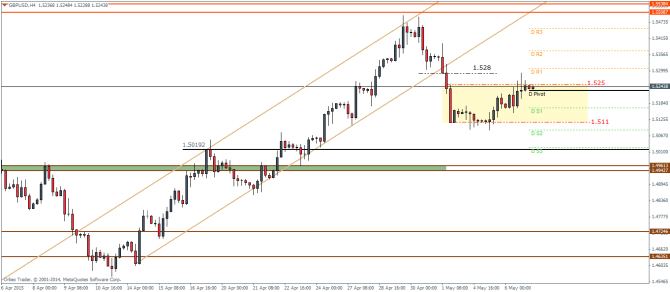

GBPUSD Daily Pivots

| R3 | 1.5449 |

| R2 | 1.5370 |

| R1 | 1.5307 |

| Pivot | 1.5228 |

| S1 | 1.5166 |

| S2 | 1.5087 |

| S3 | 1.5024 |

GBPUSD is back to its range trading, but we do notice a small test to 1.528, which was promptly rejected. A break below 1.511 is needed to see price retest the 1.50 support followed by 1.496 levels. The British Pound could be volatile as the UK General elections gets underway today and as and when the exit polls being to get published, the GBPUSD could see some volatile swings in either direction. Nonetheless, the lower side supports needs to be tested before we can anticipate any continuation of the rallies.