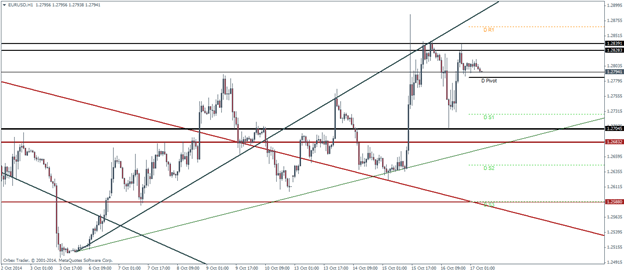

EURUSD Daily Pivots

| R3 | 1.3005 |

| R2 | 1.2925 |

| R1 | 1.2866 |

| Pivot | 1.2785 |

| S1 | 1.2727 |

| S2 | 1.2646 |

| S3 | 1.2588 |

EURUSD hit resistance near 1.2828 and 1.284 levels and promptly drifted lower. Support comes in at today’s pivot level of 1.2785, which if tested successfully, could see EURUSD try to break above the resistance. Alternatively, should the support at 1.2785 give away, EURUSD could possibly drop towards 1.275 followed by 1.27. The European trading session is likely to remain quiet without any economic news on the tap.

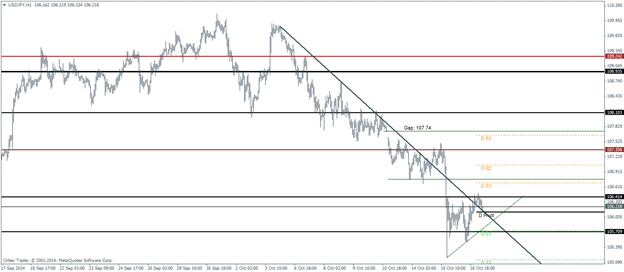

USDJPY Daily Pivots

| R3 | 107.651 |

| R2 | 107.058 |

| R1 | 106.696 |

| Pivot | 106.103 |

| S1 | 105.741 |

| S2 | 105.148 |

| S3 | 104.786 |

USDJPY looks like it could continue to consolidate within a tight range. After the decline, USDJPY looks to be forming a congestion pattern of sorts, which could potentially result in a break out. To the upside, the most immediate resistance comes in at 106.765, just above today’s first resistance level, whereas a break below the short term rising trendline could see further declines with technical supports at 105.7 and 104.7.

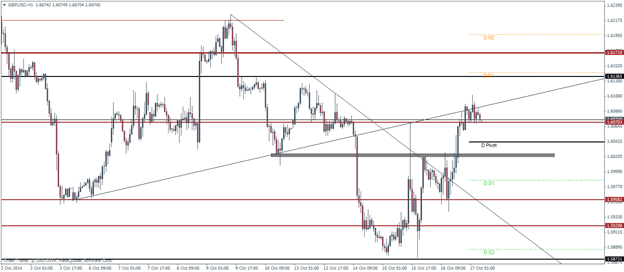

GBPUSD Daily Pivots

| R3 | 1.6298 |

| R2 | 1.6197 |

| R1 | 1.6142 |

| Pivot | 1.6042 |

| S1 | 1.5987 |

| S2 | 1.5886 |

| S3 | 1.5831 |

GBPUSD validated the identified bullish flag to reach the objective of 1.607 and stalled. Current price action shows a possible move lower towards the daily pivot at 1.604 or perhaps to the technical support lower at 1.6025. Although the cable is still technically bearish, the price action is softly hinting towards a possible upside move, a bit evident from higher time frames.