EUR/USD has fallen off the highs thanks to the dollar’s weakness (here are 3 reasons). However, it is still trading high – not too far from 1.10.

The team at Credit Agricole examines whether euro/dollar is at a turning point.

Here is their view, courtesy of eFXnews:

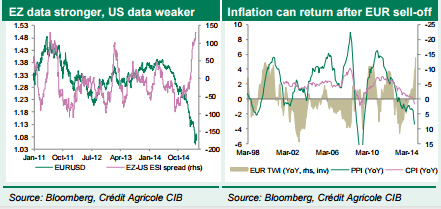

The Eurozone economic outlook is improving and portfolio flows into the region seem to be on the rise again. Hopes are growing that Greece will get short-term funding relief and investors are squaring USD-longs in the wake of the March Fed meeting. EUR/USD could consolidate some more and EUR-volatility could subside in the near term.

Our analysis so far indicates that:

1. EUR need not benefit from a further improvement in Eurozone economic datagiven that it is unlikely to significantly affect the ECB policy outlook any time soon.

2. EUR need not benefit from continuing inflows into the Eurozone (stock) markets so long as investors continue to hedge their EUR downside risks and ECB QE encourages flows in the opposite direction.

Some downside risks for EUR could linger as well. In particular, uncertainty about Greece should continue to haunt the single currency, with concerns about the country’s debt-sustainability likely to escalate as the bailout extension draws to an end in June.

Long-term risks should still be on the downside, however, and we expect EUR/USD to hit parity in Q3 with the USD-rally resuming as we get closer to the Fed’s first hike.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.