Euro dollar is vulnerable ahead of a busy day. The US rate decision is highly anticipated, but may disappoint. More positive signs are seen from Germany today, while Greece and its bondholders are still in a standoff regarding the “voluntary” haircut – this hurts the euro. The ECB is also under pressure to undergo a haircut on its Greek bonds. It’s going to get even more busy.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

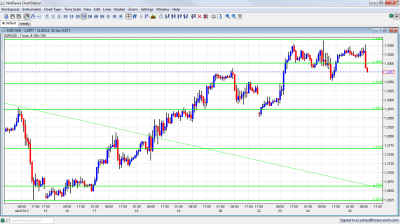

EUR/USD Technicals

- Asian session: Quiet session sees the pair very steady in the range. Drop began in the European session.

- Current range: 1.2945 to 1.30.

- Further levels in both directions: Below 1.2945, 1.2873, 1.2760, 1.2660, 1.2623, 1.2580, 1.2520 and 1.24.

- Above: 1.30, 1.3060, 1.3145, 1.3212, 1.3280, 1.3333 and 1.3450.

- 1.3060 proves to be very tough resistance, as in the beginning of the year.

- 1.2873 switches into strong support.

Euro/Dollar in range before Bernanke- click on the graph to enlarge.

EUR/USD Fundamentals

- 9:00 German Ifo Business Climate. Exp. 107.6 points. Actual 108.3 – Germany likely to avoid recession.

- 13:15 ECB President Mario Draghi talks.

- 15:00 US Pending Home Sales. Exp. -0.6%.

- 17:30 US FOMC Statement. Doves will probably fly low.

- 19:15 US Federal Reserve Chairman Ben Bernanke talks in press conference.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Fed to Detail Forecast, No QE3: For the first time, each member of the FOMC will release his own forecasts. The influx of data may be confusing, but will eventually shed more light on the thoughts of these powerful people. Regarding policy, no big change is expected. The hopes for QE will likely meet too good economic figures, and the dollar could rise.

- Greek haircut deal deep in the mud: A fresh report in the media says the the EU “is losing hope” for a voluntary deal. The EU finance ministers reject the offer for a deal made by the IIF and demand a lower interest of 3.5%, not more. It is surprising that the demand came from the EU and the IMF, after Greece already agreed to a higher coupon. It all seemed very close on Friday. It’s also important to remember that some hedge funds have an interest to see an involuntary default by Greece, which will trigger CDS that they are holding.

- Who isn’t doing enough?: There is growing pressure that the ECB will join private bondholders and accept a haircut on its Greek bonds. The pressure comes from the banks (naturally) and also from the IMF. Note that ECB president Draghi didn’t categorically reject this. EU finance ministers say that Greece is off track and must make reforms and secure PSI as soon as possible. This joins reports say that the EU and the IMF request a new report on debt sustainability, while a report on Germany’s Bild Zeitung says that these international creditors are “shaken” by the state of administration in the Hellenic Republic.

- Spain faces another auction: The euro-zone’s fourth largest economy is facing another bond auction after enjoying many successful ones that yielded more money than expected, and at lower yields. A report by the Bank of Spain says that the economy contracted by 0.3% in Q4. This was expected.

- Portugal deteriorates: The biggest victim of the multiple S&P downgrades is Portugal, which saw its yields leap. The chances of a default there are rising. The bond auction today will be closely watched. The downgrade of the bailout fund (EFSF) hasn’t hurt its bond auction. Also France, which got the historic downgrade, survived it quite well.

- ECB sees stabilization: The ECB bulletin and Mario Draghi expressed “tentative signs of stabilization” in the euro-zone.