Euro dollar prefers to remain optimistic in the new year, as the market returns to full gear. Part of the optimism comes from European leaders Merkel and Sarkozy. Is this optimism justified or is it just short covering? Today we have an initial hint towards this week’s big event: the Non-Farm Payrolls.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

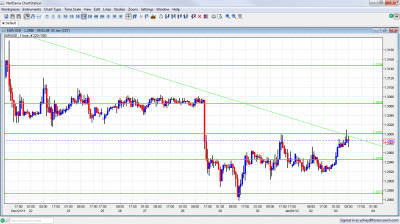

EUR/USD Technicals

- Asian session: Active session sees the pair cross the 1.2945 line once again. The 1.30 is challenged at the wake of the European session.

- Current range: 1.2945 – 1.300

- Further levels in both directions: Below 1.2945, 1.2873 , 1.2720, 1.2650 and 1.2580.

- Above: 1.30, .13060, 1.3145, 1.3212, 1.3280, 1.3380

- 1.2945 is now a pivotal line.

- The break under 1.2873 proved fake. The new 2011 low of 1.2858 was just a swing.

Euro/Dollar starting the year a bit higher- click on the graph to enlarge.

EUR/USD Fundamentals

- 8:55 German Unemployment Change. Exp. -9K. Actual -20K.

- 15:00 US ISM Manufacturing PMI. Exp. 53.3 points. See how to trade this event with USD/JPY.

- 15:00 US Construction Spending. Exp. +0.6%.

- 19:15 FOMC Meeting Minutes.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Volume returning to full capacity: Almost all trading centers are closed today, in the extended New Year’s weekend. January 3rd and January 4th are when the markets will return to full speed.

- Merkozy summit: The leaders of Germany and France plan to meet on January 9th and take new steps to fight the debt crisis. A wider summit is planned for January 30th. Merkel and Sarkozy have new steps in mind.

- Gloomy expectations for 2012: On the other hand, most media outlets posted grim outlooks for 2012 concerning the euro-zone as austerity measures push the economies into recession, this in turn triggers more austerity and the vicious circle continues.

- Hope from Far east: PMI in India jumped back to growth zone, and Chinese PMI also ticked back up. This is in great contrast to Europe’s contraction.

- Iran tests missiles: Iran proceeded with testing missiles in the Persian Gulf. The threat of closing the Straights of Hormuz supports oil prices and this weighs on the US dollar. Note that Mid-East violence could erupt in Syria, Lebanon and Israel rather than the Persian Gulf.

- Italy’s worrying auction: The euro-zone’s third largest country couldn’t raise the maximum amount of money and paid high prices once again. Yields didn’t rise, but at these levels, recycling debt will place Italy in a debt trap.

- First sign for NFP: The last figures for 2011 were OK. Jobless claims ticked up, but the moving average continues falling. The big event is Non-Farm Payrolls, the last publication for 2011 (apart from revisions). Expectations remain high for Friday’s release, for more than 100K of gains. The manufacturing PMI is a first sign.