EUR/USD got close to the round level of 1.1460 but seems to hesitate, especially with 1.1460 looming above.

The team at Credit Agricole suggests selling rallies:

Here is their view, courtesy of eFXnews:

The EUR rebounded by the end of last week, mainly on the back of rising risk aversion. Although risk sentiment may remain unstable in the weeks to come we do not expect the single currency to benefit from it sustainably.

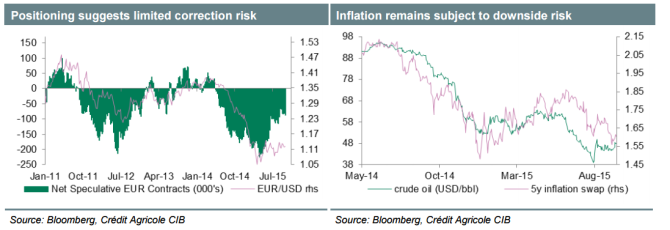

First of all, we expect ECB monetary policy expectations to start becoming a more dominant currency driver anew. Even if central bank members have not yet made a case for further policy action, a further appreciating currency should ultimately increase downside risks to inflation, especially as growth momentum remains muted. Elsewhere, we see limited room for further falling Fed rate expectations.

On the contrary, it is still possible that the Fed will consider higher rates this year, as also confirmed by several Fed members.

This in turn suggests that pairs such as EUR/USD face only limited upside risk from the current levels.

In terms of data, this week’s focus turns to the ZEW economic sentiment survey and final September CPI readings, though speeches by Constancio, Mersch and Nowotny should prove more important.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.