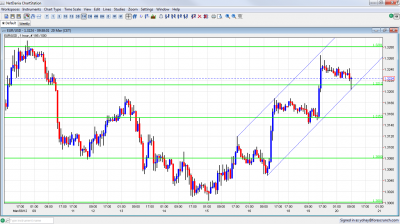

Euro dollar resumed its rises and now trades in a clear uptrend channel. The channel is parallel, and the same trading pattern repeats itself in every stage. US figures are in the limelight today, and also Bernanke will have some time in the spotlight. Today is “Greek Deliverance Day” for bond payment. After completing the deal and getting all the approvals, Greece has the money to pay. Will the relative calm allow the pair to continue rising?

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

- Asian session: A quiet session allowed the pair to consolidate the gains seen in the earlier. A small slide began at the wake of the European session, but the pair didn’t get very far, and holds to 1.3212.

- Current range: 1.3212 to 1.3280.

- Further levels in both directions: Below: 1.3212, 1.3150, 1.3080, 1.30, 1.2945, 1.2873 and 1.2760.

- Above: 1.3280, 1.333, 1.3430, 1.3486, 1.3550 and 1.3615.

- Uptrend channel: Note the nice pattern of sharp rises, consolidation and a small slide lower before the next step.

- 1.30 serves as strong support once again, and not only a round number.

- 1.3280 proved to be strong on the upside once again. The pair is getting closer to this line once again.

Euro/Dollar sliding back towards channel – click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German PPI. Exp. +0.5%. Actual +0.4%.

- 12:30 US Building Permits. Exp. 0.69 million.

- 12:30 US Housing Starts. Exp. 0.70 million.

- 14:00 US Treasury Secretary Tim Geithner talks.

- 16:45 US Federal Reserve Chairman Ben Bernanke talks.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment – Details of hurdles

- Deliverance Day for Greece: March 20th was the dreaded day of Greek bond repayment. After the IMF joined the Eurogroup and gave the final approval to the second Greek bailout, Greece has the money to pay back its debt. Greece completed the PSI successfully and the new estimation is that Greece will now reach a debt-to-GDP ratio of 117% in 2020. A fresh troika reports see Greece missing 2013 targets already, with more austerity needed after the elections. A projection from the Bank of Greece sees deep recession.

- PSI – deadline open for foreign law bonds: Greece completed the PSI for Greek law bonds. The new ones are already trading at a quarter of a euro on the euro, reflecting a high chance of another default. CDS payments were settled yesterday. There is a small portion of bonds under international law. The deadline for the PSI on these bonds is March 23rd.

- Iran conflict heating up: In an unprecedented move, SWIFT announced it will cut off Iranian financial institutions from Saturday. This joins heightened rhetoric in Israel and elsewhere, and keeps oil high. See 5 signs that a war with Iran is getting closer.

- Chinese demand slumps: Many find Chinese figures hard to believe, yet comments from Australia’s BHP regarding lower demand from the economic giant are taken more seriously. Fresh figures showed more drops in real estate prices in the economic giant. Shifting from an export based economy to domestic consumption isn’t easy, and this has an effect on the global economy.

- Bernanke effect reversed: The FOMC left policy unchanged, as expected. This strengthened the US dollar significantly and triggered a dollar storm. The statement included an acknowledgement of higher oil prices and a more upbeat wording regarding employment, such as “the unemployment rate has declined notably”. .The initial storm faded away with a strong reversal on Friday, which continued since then. Has this reversal come to an end.

- US bond yields in focus: Yields on short term and long term US yields are on the rise, and this pushes funds into dollars. When yields retreated a bit, the dollar followed. The effect is stronger in USD/JPY, but EUR/USD can’t ignore it. Since Bernanke’s move, stock markets and the dollar move together. This is a big change. Good US news helps the dollar, and bad news weakens it. This may sound very normal, but it hasn’t always been this way. See the video explanation here.

- Draghi warns about inflation: The ECB left rates unchanged and made no policy changes. In the press conference, Draghi was very satisfied with the LTROs. He also warned about inflation, and said that the ECB has tools to fight it. Today’s CPI will provide more insight.

- Portugal in trouble: There are heavy doubts if Portugal could return to the markets anytime soon. A second bailout program is certainly on the cards. Even worse, this may not be enough, and the peripheral country might be needing a restructuring similar to Greece. Portuguese bond yields remain high and fighting debt through austerity proves hard.