Euro/dollar remains in range, as fears on both sides of the pond increased but remained balanced. With the narrowing channel closing on the pair, perhaps we will see a breakout . The main event of this busy week is the rate decision by the ECB, which will come after inflation and employment figures. Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

The spotlight on Spain becomes stronger: S&P cut their credit rating and almost every 1 in 4 Spaniards is unemployed. Purchasing managers’ indices have shown that the situation is serious in Europe, as have other indicators across the continent. US economic indicators have been worrying as well, but but the general picture is not bad enough for QE3.

Updates: The trading week started off with a host of economic releases. German Retail Sales climbed 0.8%, exactly as predicted. M3 Money Supply beat the market forecast as it posted an increase of 3.2%. The figure represents the best reading since July 2009. Private Loans increased by 0.6%, lower than the market prediction of 0.8%. Euro-zone CPI Flash Estimate came in at 2.6%, a notch above the market forecast of 2.5%. Italian Prelim CPI exceedeed the market forecast of 0.3%, posting an increase of 0.5%. EUR/USD is steady in the European session, trading at 1.3222. The euro moved higher following the weak US PMI release on Monday. EUR/USD is trading at 1.3254. May 1 is a national holiday in Germany, France and Italy, so the US will take center stage, with four releases later in the day, including Manufacturing PMI. The Euro has lost almost a full cent, tumbling on the poor employment releases out of the Euro-zone on Wednesday. A strong PMI reading in the US also contributed to the fall. German Unemployment Change showed an increase of 19K, much worse than the forecast of -9K. The Italian Unemployment Monthly Rate also was weak, coming in at 9.8%. Estimates stood at 9.3%. After these gloomy figures, the markets breathed a slight sigh of relief at the Euro-zone Unemployment Rate, which posted a reading of 10.9%, matching the market forecast. The Euro-zone Final Manufacturing PMI was also very close to the market forecast, with a reading of 45.9 points. Traders shouldn’t expect any break in the action, as US Unemployment Claims, a key indicator, will be released on Thursday. Also on Thursday, the ECB will set the interest rate level. The markets are not expecting any change to the current level of 1.0%. French 10-y Bond Auction released figures of 2.96\2.0. Euro-zone PPI came in at 0.5%, slightly below the market forecast of 0.6%. All eyes are on the ECB interest rate announcement, followed by a press conference. EUR/USD has steadied after yesterday’s tumble, and was trading at 1.3136.

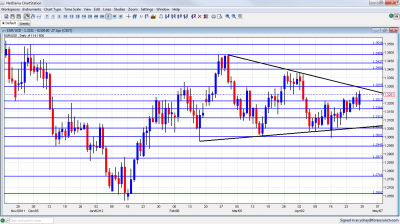

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Retail Sales: Publication time unknown at the moment. Europe’s No. 1 economy saw the volume of sales squeezing in 4 out of the past 5 months, with drops of over 1% in the past two months. This will probably be corrected with a nice rise this time.

- M3 Money Supply: Monday, 8:00. The ECB observes the amount of money in circulation as another indicator of inflation. After dropping at the end of 2011 below 2%, the pace picked up once again and reached to 2.8% last month. A similar annualized pace is predicted now.

- CPI Flash Estimate: Monday, 9:00. Headline inflation has been around 2.6%-2.7% in the last few months. The initial read for April is expected to show a similar number, still above the 2% target. The relatively high inflation is causing worries in Germany.

- German Unemployment Change: Wednesday, 7:55. The German economic strength is clearly seen in the job market. A drop in the number of unemployed people is reported almost each month. A similar drop to last month’s 18K is likely now.

- Final Manufacturing PMI:Wednesday, 8:00. According to the initial read of the purchasing managers’ survey, the manufacturing sector is contracting for a 9th month in a row. The score of 46 points is the lowest seen since mid 2009. This is another wave of deterioration after the score already advanced towards 50 points (separating growth and contraction) 3 months ago.

- Unemployment Rate: Wednesday, 9:00. While Germany continues enjoying a drop in unemployment, the general picture for the whole continent is quite depressing: the unemployment rate for the euro-area rose to 10.8% last month, and isn’t expected to change now.

- French Industrial Production: Thursday, 6:45. Europe’s second largest economy saw slow growth in its industrial output in the past two months: 0.2% and 0.3%. A drop in a similar scale is likely now.

- PPI: Thursday, 9:00. Producer prices provide another indication of inflation, and they have exceeded estimations in the past two months. Rises of 0.8% and 0.6% were recorded. A smaller rise is predicted now.

- Rate decision: Thursday, 11:45, press conference at 12:30.

The gap between north and south has widened. Countries such as Spain and Italy are contracting and suffer no inflationary pressures whatsoever. They would definitely enjoy lower rates to help them grow. On the other hand, Germany is in danger of overheating: employment is high, growth is stable and prices are on the rise. Fear of inflation has already been expressed by German officials.For now, the ECB will keep rates at 1%, and will not introduce a third LTRO scheme for now. There still is a chance for a rate cut in 2012. This can happen if the German economy weakens, and especially if German inflation eases. In this case, the ECB will have a full mandate to cut rates to new historic lows.

- Final Services PMI: Friday, 8:00. Similar to the manufacturing sector, also the contraction in the services sector is deepening once again. The initial read for April showed a score of 47.9, lower than 49.2 seen last month. This will probably be confirmed now.

- Retail Sales: Friday, 9:00. After a minor slide of 0.1% last time, a small rise is predicted now. It’s dependent on the German results published before the figure for the whole continent.

* All times are GMT

EUR/USD Technical Analysis

€/$ kicked off the week with a first failed attempt to cross the 1.3212 line (mentioned last week). It hen fell to around 1.3110 before climbing again and challenging uptrend resistance, which wasn’t broken, despite a move higher and the close at 1.3250.

Technical lines from top to bottom:

1.3615 is a high line which worked in both directions in the fall of 2011. Hints about QE3 could send the pair there, but this is highly unlikely. 1.3550 capped the pair in November and December and marked the beginning of the plunge.

1.3486 was a distinctive double top in February 2012 and is a strong cap. It’s closely followed by minor resistance at 1.3437. The pair struggled there when it traded higher.

The round number of 1.34 is now the top border of the wide range. It capped the pair in the most recent surges. The next line below is round as well:, 1.33 was tough resistance 4-5 times, with two attempts very recently. It remains key resistance.

1.3212 held the pair from falling and switched to resistance later on. It proved itself as resistance once again in April 2012. This was the bottom border of tight range trading in February. It is now pivotal as a support line. 1.3165 is now of higher importance. The line provided some support in December 2011 and worked as resistance in April 2012. It is stronger once again

1.3110 is another minor line that capped the pair in January and later in April 2012 as a stepping stone for a move higher. 1.3050 worked as support in April 2012 and also in March, and is the last frontier before 1.30.

The round number of 1.30 is psychologically important and proved to be a place of struggle. The failure to breach it in April 2012 showed its strength once again.

The 1.2945 line is stronger once again and still provides support. 1.2873 is the previous 2011 low set in January, and it returns to support once again. This is a very strong line separating ranges.

1.2760 is a pivotal line in the middle of a recent range. It provided support early in the year. 1.2660 was a double bottom during January and the move below this line is not confirmed yet. 1.2623 is the current 2012 low, but only has a minor role now.

Narrowing Channel

As you can see in the chart above, the trading range of the pair is narrowing down. Both lines began in February, with uptrend support being more significant than downtrend resistance. A breach below this line was very temporary in its nature, and an attempt to break above downtrend resistance failed, making the line even stronger now.

In addition, here is a recent Elliott Wave Analysis of the pair, which points to low ground.

I am bearish on EUR/USD

Spain is in deeper trouble, suffering a toxic mix of economic troubles. Other euro-zone countries aren’t doing better, as PMIs and other indicators show. Tension remains high towards elections in Greece and France next week, with the projected results not too favorable for the euro.

In the US, things aren’t looking that good either, but the economy is still growing and not close to a recession. With persistent inflation (also acknowledged by the Fed), the chances of QE3 remain low. Even Bill Gross gave up on hopes for more dollar printing.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.