Euro/dollar couldn’t hold to gains, as the second Greek bailout deal couldn’t be sealed. Is Greece close to a breaking point? The initial GDP releases are the highlights this week, as news from Athens continues flowing. Here is an outlook for this week’s events and an updated technical analysis for EUR/USD.

ECB President Mario Draghi left rates unchanged and expressed a lot of confidence in the press conference. In a last moment statement, Draghi also left the door open for an ECB contribution to Greece. Unfortunately for Greece, it first has to comply with the troika’s demands and pass harsh austerity legislation, before it is awarded any help.

Updates: The Greek parliament approved austerity, and the euro goes up. Nevertheless, worries that Greece will renegotiate the terms after the elections limit the rally. The euro got some energy from the optimistic economic sentiment. Yet the heavy doubts about Greece weigh heavily on the pair, which is now lower in the range. See how to trade the Euro-zone GDP with EUR/USD. The pair now trades in a downtrend channel, but the milder than expected recession in Europe, and especially in France certainly keeps the pair afloat. There is a war of words between the Germans and the Greeks about Greek meeting conditions. Together with lower chances of dollar printing in the US, the pair is around 1.30, struggling in a falling channel. There are growing signs that deal for Greece is coming on Monday. This sent the pair to a higher range. Also Elliott Wave analysis points to higher levels in February.

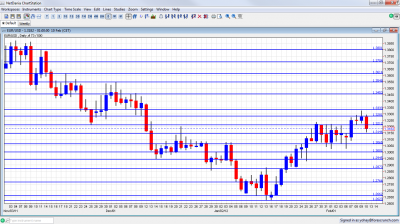

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Greek vote: Sunday. The Greek parliament will vote on cutting the minimum wage and additional measures in order to receive the second bailout, that includes a haircut for private bondholders (PSI). Politicians still have to find over 300 million euros of budget cuts. Previous negotiations already caused delays and a loss of part of the government. With protests on the streets of Athens, a miss of January’s tax revenue goals, a very shaky coalition and a past of endless delays, the vote could be held after markets open, adding to uncertainty. The vote is expected to pass, but Greece is far from being stable.

- German WPI: Monday, 7:00. Wholesale prices stayed unchanged after two months of bigger changes: a rise of 0.7% and a drop of 1%. A gain of 0.4% is expected now.

- French Non-Farm Payrolls: Tuesday, 7:45. The is the preliminary report for Q4. Europe’s second largest economy saw no change in the size of its workforce in Q3, after a small expansion of 0.2% in Q2. A rise of 0.2% is expected now. A shrinkage will cast big worries on France’s position as a core euro-zone nation.

- German ZEW Economic Sentiment: Tuesday, 10:00. This highly regarded survey tends to be pessimistic. Nevertheless, when the score leaped from -53.8 to -21.6 points last month, it gave a boost to the euro. A negative score, reflecting pessimism among the 350 analysts and investors surveyed, is expected to persist for a ninth month in a row, but the score will likely tick up to -11.6 points. The figure for the whole continent (less important) will probably tick up from last month’s -32.5 points to -21.1

- Industrial Production: Tuesday, 10:00. Germany and France already released their numbers. Nevertheless, the wide figure still provides surprises. Output fell in the past three months, and will likely fall down once again, this time by a larger scale of 1.1%. Last month saw a minor drop of 0.1%.

- French GDP: Wednesday, 6:30. France is in a delicate position after losing its AAA rating. The economy already squeezed in Q2 (by 0.1%) but grew again in Q4, by 0.3%, avoiding an official recession. Q4 will likely see the economy squeeze once again, starting the series of GDP releases with a negative tone. Contraction of 0.2% is predicted.

- German GDP: Wednesday, 7:00. Europe’s No. 1 economy likely saw a squeeze in its economy, despite enjoying better economic conditions than many other countries. A drop of 0.3% is expected in GDP. Germany saw growth rise from 0.3% to 0.5% in Q3, Germany has better chances of escaping recession, and could return to growth in Q1.

- Italian GDP: Wednesday, 9:00. Italy is of special importance this time. Th euro-zone’s third largest economy delayed its Q3 report and eventually reported contraction of 0.2%. A bigger drop is expected this time: 0.6%. This will officially put Italy in a recession. A smaller economy enlarges the debt-to-GDP ratio and will cast worries, even if Greece is still in the limelight.

- Euro-zone GDP: Wednesday, 10:00. The euro-zone as a whole grew by only 0.1% in Q3. Purchasing managers’ indices from recent months, together with retail sales figures, all point to contraction, with -0.4% being the estimation. This will likely weigh on the common currency. Spain’s estimates pointed to contraction in Q4.

- Trade Balance: Wednesday, 10:00. Germany’s export machine pushed the trade surplus much higher in November: 6.1 billion. This probably squeezed in December, but no deficit is expected. A surplus of 4.9 billion is on the cards.

- ECB Monthly Bulletin: Thursday, 10:00. One week after Draghi’s decision to keep rates unchanged and impressive press conference, we will get to see the figures that the members based their decision upon. The concerns will likely be seen in this report.

- German PPI: Friday, 7:00. After three consecutive months of growth, German producer prices dropped by 0.4%. A return to rises is expected now, at the same scale of 0.4%. Producer prices are eventually echoed in consumer prices.

* All times are GMT

EUR/USD Technical Analysis

EUR/USD opened with a small gap lower and quickly covered it. It then surged. After crossing the 1.3212 line, mentioned last week, the line switched to support, that was eventually lost (although the line remained a distinct separator), and the pair returned to the range, closing at 1.3182.

Technical lines from top to bottom:

We start from the round number of 1.38, that stopped the pair in September and also later on. It is weak and distant resistance. 1.37 had a similar role at the same time and also worked as support afterwards. It is stronger resistance.

1.3615 switched from support in October to support in November and is now resistance. 1.3550 capped the pair in November and December and marked the beginning of the plunge.

1.3450 was support in November and then switched to minor resistance. It used to be a stronger line, but is only minor now. 1.3330 provided some support for the pair during December 2011 and is a stronger line now. EUR/USD got close to it in February 2012.

Quite close by, 1.3280 had a similar role at the same time, and is now weaker, after serving as a battleground and being shattered. 1.3212 held the pair from falling and switched to resistance later on. This is a key resistance line, as seen more than once in February 2012.

The 1.3145 line, which was the lowest point recorded in October 2011, is now a pivotal line in the middle of the range, with a slightly stronger role. 1.3060 was the top border of a very narrow range that characterized the pair towards the end of 2011. It is now key support on the downside after serving as the bottom border of the range and despite a temporary move under this line.

The round number of 1.30 is psychologically important but is much weaker now. It was a pivotal line before Bernanke’s rally. The 1.2945 line is stronger once again and still provides support.

1.2873 is the previous 2011 low set in January, and it returns to support once again. This is a very strong line separating ranges. 1.2760 is a pivotal line in the middle of a recent range. It provided support early in the year.

1.2660 was a double bottom during January and the move below this line is not confirmed yet. 1.2623 is the current 2012 low, but only has a minor role now.

A more important line is 1.2587, the trough of August 2010. This line will be closely watched on any move downwards. A break below this line will send the pair to levels last seen 18 months ago.

I remain bearish on EUR/USD

Greece is close to a breaking point. With the union of policemen threatening to arrest troika representatives, anti-austerity parties gaining traction in polls and a truly dire economic situation, Papademos will have a hard time in passing austerity. Even if everything goes well, the situation will continue deteriorating, as seen many times in past, and new measures will be needed. Of course, Portugal is around the corner. And now, the euro-zone will officially see that it is heading into a recession, so the debt burden will persist.

In the US, the dovish sentiment remains despite improving signs. QE3 is still possible in March, but this topic will likely be sidelined this week.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.