Euro/dollar didn’t need a gap in order to fall again and reach a 22 month low. Greece and Spain just look worse with every day that passes by. Will the common currency fall for a fifth week in a row? Here is an outlook for the upcoming events and an updated technical analysis for EUR/USD.

The talk about a Greek exit of the euro-zone is accelerating and there are reports that even Greece is actively working on a new currency, just as tax revenue falls again. Spain’s rich Catalonia region needs government help just after the recently nationalized Bankia is asking for more money. And speaking of the rich, Germany is in trouble as well: manufacturing is falling fast, together with plunging business confidence.

Updates: Concerns eased over a Greek exit from the Euro-zone, as a Greek poll indicated that the pro-bailout New Democracy party would be able to form a coalition after the June election. However, the euro gave up these gains on Monday, after Spain announced Sunday that it intends to recapitalize Bankia, the country’s fourth largest lender. EUR/USD was steady in the European session, trading at 1.2577. There are no scheduled releases in the Euro-zone or US today, as the markets are closed for holidays in France, Germany and the US. The euro continues to drop, as the markets remain wary about the troubled banking sectors in Greece and Spain. The EFSF transferred 18 billion euros to Greek’s largest banks to help them cope with ongoing pressure. In Spain, the government announced the injection of 19 billion euros to Bankia, the country’s fourth largest lender. German Import Prices fell by 0.5%, an eight-month low. German Prelim CPI will be released later on Tuesday. EUR/USD lost ground, and was trading at 1.2539. The euro continues to fall, on market concerns over funding issues in Spain and Italy. German and Euro-zone releases were a disappointment. German Import Prices fell 0.5%, below the market forecast of a drop of 0.2%. German Prelim GDP posted a -0.2% reading, below the market estimate of -0.1%. Euro-zone Money Supply came in at 2.5%, well below the market forecast of 3.4%. Euro-zone Private Loans were up 0.3%, which was lower than the market estimate of 0.7%. Eurozone Retail PMI came in at 43.3 points, up from the April reading of 41.3. The eagerly-anticipated Italian 10-y Bond Auction recorded yields of 6.03/1.4. The markets will also be scrutinizing a speech by ECB head Draghi later on Wednesday. EUR/USD was steady, trading at 1.2448. The euro finally reversed its downward plunge on Thursday, after some strong data out of Germany and France. German Retail Sales were strong, posting a 0.6% increase. This easily beat the estimate of 0.1%. German Unemployment was unchanged, but the German Unemployment Rate nudged down from 6.8% to 6.7%. ECB President delivered a speech at the European Parliament in Brussels. The Euro-zone CPI Flash Estimate came in at 2.4%, just below the market forecast of 2.5%. Italian Prelim CPI was a flat 0.0%, a notch below the estimate of 0.1%. On Thursday, Ireland is holding a referendum on the EU Stability Treaty, which most EU members have already ratified. If voters reject the treaty, the IMF could hold back bailout funds, which are critical to an economic recovery. EUR/USD has edged down, and was trading at 1.2405.

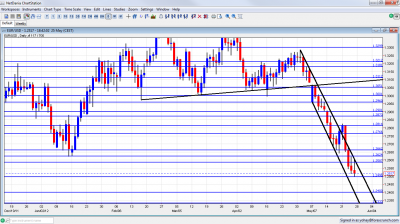

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German CPI: Tuesday. The initial release of inflation data is made separately for every German state. The headline consumer price index has stabilized in the past two months, with gradual rises. Little change is expected now.

- German Import Prices: Tuesday, 6:00. After two months of strong rises, import prices rose by only 0.7% last month. A correction is likely now: a drop of 0.2%. This inflation indicator is important, as the ECB’s rate policy leans towards Germany.

- M3 Money Supply: Wednesday, 8:00. After dropping to dangerous levels late in 2011, the amount of money in circulation returned to normal pace and accelerated to 3.2% in March. Also April will probably see another acceleration of expansion, to 3.5%, thanks to the massive liquidity injection of 1 trillion euros by the ECB.

- German Retail Sales: Thursday, 6:00. The volume of sales managed to recover after two months of drops at the beginning of the year. Following the 0.8% rise, another small tick up is likely in April, 0.2%. May will probably be different, reflecting the rising uncertainty.

- French Consumer Spending: Thursday, 6:45. Europe’s second largest economy saw a plunge in consumer spending last time: 2.9%, countering a similar rise beforehand. A return to normal changes is expected now, with a small fall likely.

- German Unemployment Change: Thursday, 7:55. Europe’s locomotive usually enjoys constant drops in the number of unemployed people. So, last month’s rise of 19K was quite worrying. A return to drops is predicted now, with 7K less unemployed. Germany enjoys a much lower unemployment rate than the average euro-zone country.

- CPI Flash Estimate: Thursday, 9:00. Headline inflation is above target, and perhaps that’s why the ECB is refraining from cutting the interest rate below the historic low of 1%. After standing at 2.6% last month, a small slide to 2.5% is expected now, but it isn’t expected to fall under the 2% target.

- Irish Referendum: Thursday, results in the evening. There are doubts whether the fiscal compact agreed by Merkel and Sarkozy will ever see the day of light. Nevertheless, the Irish government has put the treaty, with its automatic budget cuts, up for vote for the Irish public. Currently, the “Yes” camp seems to lead, as many people are afraid that a “No” vote will end in expulsion from the euro-zone and no more bailout money. A “Yes” vote will likely help the euro in the short run. In the meantime, fresh real estate numbers show that Irish house prices have accelerated their falls.

- Italian Manufacturing PMI: Friday, 7:45. The euro-zone’s third largest economy squeezed sharply in Q1: 0.8%. This forward looking figure is now more important, especially after it fell off the cliff and hit 43.8 points last time. After Germany’s manufacturing sector dived, there isn’t too much hope for Italy. A score of 43.5 is predicted.

- Final Manufacturing PMI: Friday, 8:00. The weak German and French figures led to a big disappointment in the initial PMI figures for the whole continent: a score of only 45 points. This will likely be confirmed now. A drop to lower ground, like the French figure of 44.4, will add pain to the euro.

- Unemployment Rate: Friday, 9:00. While Germany enjoys a low unemployment rate, southern countries see unemployment on the rise. Another tick up is predicted from last month’s 10.9% rate, to an even more alarming rate of 11%.

* All times are GMT

EUR/USD Technical Analysis

€/$ opened the week without a gap for a change. After an attempt to climb over the 1.2814 line (mentioned last week), the pair fell and even dipped under the 1.25 line.

Technical lines from top to bottom:

We start from an even lower point this time. 1.3050 worked as support in April 2012 and also in March, and is next frontier above 1.30. The round number of 1.30 is psychologically important and proved to be a place of struggle. After the downfall, the pair made another attempt to fight over this line, but this failed.

1.2960 is minor resistance after capping the pair following the downfall in May 2012. It is followed by 1.29 which provided support more than once after the fall.

Very close, 1.2873 is the previous 2011 low set in January, and it is distant resistance now. This is a very strong line separating ranges, as also seen in May 2012. 1.2814 is now stronger after being a clear line separating ranges in May 2012.

1.2760 is a pivotal line in the middle of a range. It provided support early in the year and is now of high importance. 1.2660 was a double bottom during January and the move below this line was confirmed after a struggle.

1.2623 is the previous 2012 low and remains important, now as resistance. Attempts to rise above this line have been . Below, 1.2587 is a clear bottom on the weekly charts but is only minor resistance now.

The round number of 1.25 is of psychological importance, although not so much on the technical level. This is an important battle line. Another round number is the next support line: 1.24. It provided some resistance in June 2010 and is now minor support.

Further below, 1.2330 is another historical line after being the trough following the global financial meltdown in 2008. 1.22 is minor support below, after serving as such in June 2010.

1.2144 is already a very strong line on the downside: it was a clear separator two years ago, when Greece received its first bailout. The round number of 1.20 is of course highly important in the psychological level.

Below, the 2010 trough of 1.1876 is apparent, before the launch value of the euro at 1.17 to the dollar in 1999.

Steep Downtrend Channel Broken and Recaptured

The steep down trend channel is still relevant. It was temporarily broken, but the pair returned to it quite fast. EURUSD is now in the middle of the channel, as the chart above shows. Staying in this channel means steep falls.

I remain bearish on EUR/USD

Greek polls are once again leaning towards the anti-bailout parties, but markets don’t really need the elections. With the louder talk about contingency plans for a euro exit, the ball is already rolling. While it’s good to know that important bodies are getting ready, the implications of a Grexit for the European banking system and for other countries are not fully priced in. Here’s how to trade the Grexit with EUR/USD.

Spain has serious problems of its own, with the banking system and the regions leaning on the government for money. They are already shut of the markets. How long will Spain remain in the bond markets without help? A coordinated action by central banks can help Spain and lift the euro. So far, the ECB seems very reluctant to budge. The US economy is still OK, and it plays second or third fiddle to the dramatic European events.

If you have interest in a different way of trading currencies, check out the weekly binary options setups, including EUR/USD, GBP/JPY and more.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar forecast.