EUR/USD is trading in a wide range, and that is set to continue according to SocGen. And what happens afterwards?

The markets aren’t pricing everything. Here is what’s next for the pair:

Here is their view, courtesy of eFXnews:

In its weekly note to clients, SocGen discusses the duration of EUR/USD cycles and its potential implication on trading EUR/USD over the coming months.

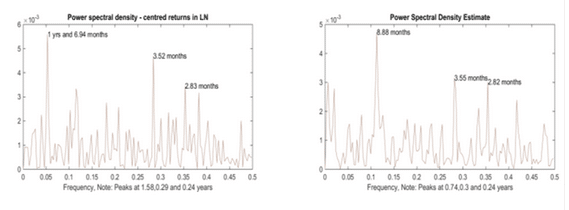

“EUR/USD has cycles typically lasting either three or nine months. With the long drop in EUR/USD past us, we are likely headed for a three-month cycle. The next few months should hopefully confirm that the US slowdown was weather related, leaving the market to reprice the Fed’s path of tightening. A wider divergence in beliefs means volatile portfolio flows that typically last three months,” SocGen notes.

“Differing beliefs mean that one group of investors can offload to another without too much price impact. As the trend builds or collapses, beliefs become one sided, leading to a highly inelastic supply of risk, and cross-border portfolio flows therefore have a disproportionate impact on the exchange rate,” SocGen adds.

Trading implication:

1- “With EUR/USD heading for a three-month cycle after a nine-month one, the probability of a large short covering later in the summer or autumn is quite large and significantly underpriced in the forward volatility curve. It presumes a downward sloping term structure and underprices upside risk in EUR/USD,” SocGen argues.

2- “More broadly, an environment with a much wider divergence of beliefs should give investors plenty of opportunities to rebalance their portfolios, a result typical of multi-agent/macroscopic models,”SocGen adds.

3- “Such buying and selling at the extreme of the range should mean range trading in a wide band into the summer before a probable severe break out,” SocGen projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.