The euro’s behavior has been quite erratic of late, but its recent pattern is quite telling and indicates a clear direction going forward.

The team at BNP Paribas explains:

Here is their view, courtesy of eFXnews:

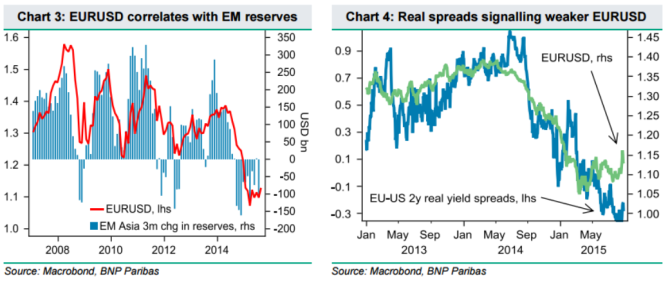

“EM FX reserves surged during Fed QE in 2008-2014 with China alone accumulating around USD 2trn in reserves during that period. The impact of the EM currency sell-off on the G10 has been to boost demand for the EUR and other G10 currencies as EM central banks diversified their USD purchases. In other words EM central banks maintained weaker currencies and larger trade surpluses at the expense of stronger currencies elsewhere. Not surprisingly there has been a robust link between EM reserve accumulation and EURUSD,” BNPP notes.

“We see the picture likely reversing, ie, just as EM reserve accumulation created extra upward pressure on EURUSD, a decline in EM reserves can add to downward pressure,” BNPP argues.

“We acknowledge that EM reserve flows by themselves are unlikely to restart the weak EUR trend. However, we believe they will contribute to the overall long-term portfolio outflows from the eurozone that should remain driven by negative domestic real rates. Current real rates spreads signal a weaker EURUSD,” BNPP adds.

Finally, BNPP thinks the very clear negative correlation between equity markets and the EURUSD is significant.

“Six sharp daily declines in global equities correspond with the sharp rally in EURUSD… The EUR is increasingly trading like the JPY, whereby there is a strong link between the USDJPY and the Nikkei 225 Index. We anticipate that this relationship will hold during the period of ECB QE which is likely to last at least until September 2016,” BNPP argues.

“Given this strong correlation, as equity markets return to positive territory, EURUSD should decline again. Already, the spike above 1.15 appears to have represented an excellent selling opportunity. At this stage we expect the drivers of real interest rate differentials and portfolio flows to re-engage and to push EUR lower towards the year-end,” BNPP advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.