As the USD continues strengthening quite strongly, what are the next possible traders?

The team at Bank of America Merrill Lynch sees more dollar opportunities:

Here is their view, courtesy of eFXnews:

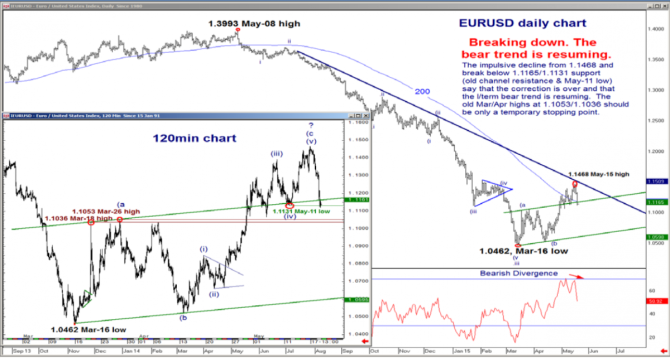

EUR/US has broken below the confluence of near term support at 1.1165/1.1131 (2m, old channel resistance, now support and the May-11 low), notes Bank of America Merrill Lynch.

“A break below here is needed to indicate a top and resumption of the long term bear trend. Going forward, bounces should be sold,” BofA advises.

“Next support to note is seen at 1.1053/1.1036 (old Mar/Apr highs), but these should be only a temporary stopping points ahead of 1.0535/98 (2m channel base), then 1.0462 (Mar-16 low), and then the 1.0283, long term targets,” BofA projects.

Meanwhile, BofA reiterates its bullish view on USD/JPY expressing that via maintaining a long position targeting a move to 124.59.

“Evidence continues to say that the contracting range of the past 4+ months is drawing to a conclusion and the long-term uptrend is set to resume for 124.59, ahead of 128.45. Below 118.33 invalidates this view and points to continued range-trading,” BofA adds.

“Those awaiting additional price confirmation should watch for a break 120.86 (Apr-13 high). We recommend adding to long positions on a break 120.86,” BofA advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.