The dollar has been losing to its major currency peers due to risk aversion. The yen has been a traditional safe haven and the euro recently became one as well. Can this change?

Dollar bulls will ride higher one more time, says the team at CIBC:

Here is their view, courtesy of eFXnews:

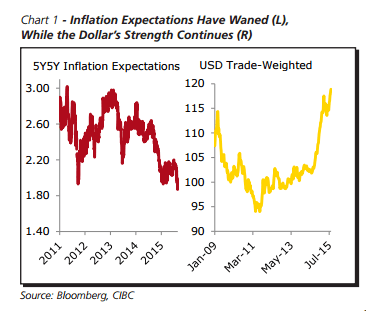

In its monthly note to clients, CIBC World Markets argues that while the US dollar’s has taken a breather recently, the rodeo’s not over, projecting that Dollar bulls are ready to make another appearance with Fed monetary policy set to tighten before the end of the year. The following are the main points constituting CIBC’s argument along with its strategy on when to buy the USD and its latest forecasts for EUR/USD, and USD/JPY.

1- Treasury yields will also have a rockier ride higher. After almost seven years of being at the zero-lower bound, the first rate increase will signal the start of a new, if gradual, upcycle and spark US rates higher across the curve.

2- When the time comes, higher rates will be in significant contrast to the country’s major trading partners, which are generally in the midst of easing policy. The US is more insulated from the issues plaguing other economies, given its large and healthy domestic market and the solid gains seen in employment recently. Even the recent pull back in equities looks less dramatic in the context of the multi-year run-up that preceded it.

3- As a result, if the Fed jumps ahead of the market by hiking in September or October, the knee jerk reaction would be to buy dollars against other majors, revisiting the dollar strength seen earlier this year when a September hike seemed more certain.

4- Thereafter, however, the pace of additional tightening could underwhelm dollar bulls. Both the trade dent from US dollar strength and the market’s skepticism about inflation heading back to the Fed’s target could temper the Fed’s path. That should see the funds rate not far from 1% even as late as the end of 2016.

CIBC sees EUR/USD trading at 1.08 and USD/JPY at 125 by year-end.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.