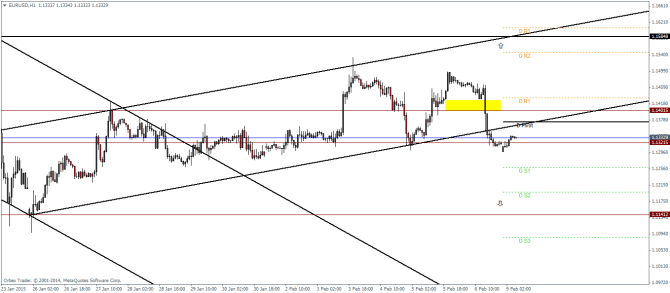

EURUSD Daily Pivots

| R3 | 1.1607 |

| R2 | 1.1546 |

| R1 | 1.1433 |

| Pivot | 1.1372 |

| S1 | 1.1259 |

| S2 | 1.1197 |

| S3 | 1.1084 |

As EURUSD failed to rise above 1.14015 and instead broke down below, we expect a short retracement towards the daily pivot to as high as 1.14015 following which we can expect a decline down to 1.11412, a major support level. To the upside, we expect a break above 1.14015 and potentially a higher close in order to take the bias for an upside move.

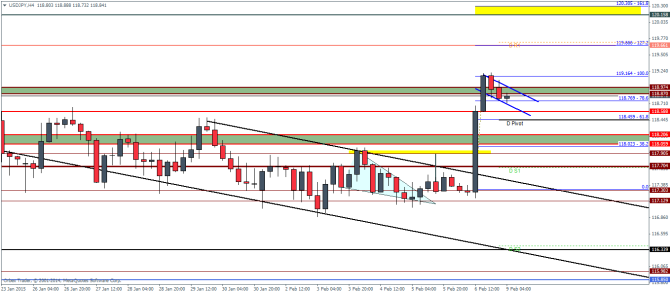

USDJPY Daily Pivots

| R3 | 121.764 |

| R2 | 120.492 |

| R1 | 119.72 |

| Pivot | 118.448 |

| S1 | 117.676 |

| S2 | 116.404 |

| S3 | 115.632 |

From Friday’s notes, price rallied to the expected target near 117.8 levels and closed higher. In the process, USDJPY has formed a bullish flag pattern near the support/resistance level. On a confirmed close or a bullish candlestick pattern near the support/resistance at 118.97, we can expect a continuation of the rally with the prospects of reaching 120.3, the minimum measured price objective of the bullish flag pattern. A close below the daily pivot level could potentially invalidate or weaken the flag pattern.

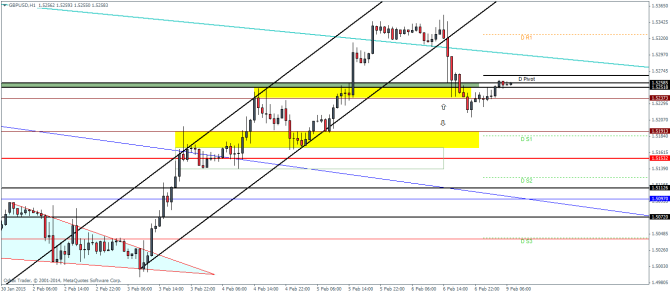

GBPUSD Daily Pivots

| R3 | 1.5467 |

| R2 | 1.5409 |

| R1 | 1.5326 |

| Pivot | 1.5268 |

| S1 | 1.5184 |

| S2 | 1.5127 |

| S3 | 1.5043 |

GBPUSD broke out from the rising price channel and looks to be currently retesting the break out levels. If successful and prices reversed without making a new high, we expect a decline down to 1.519 levels, which forms the first support zone. A break below this level could potentially target 1.515 support. Alternatively, should price rally higher, a break of the major price channel’s resistance line is required in order to see more gains in the pair.

In our latest podcast, we do an Aussie Analysis, Greek Grindings and Oil Optimism.