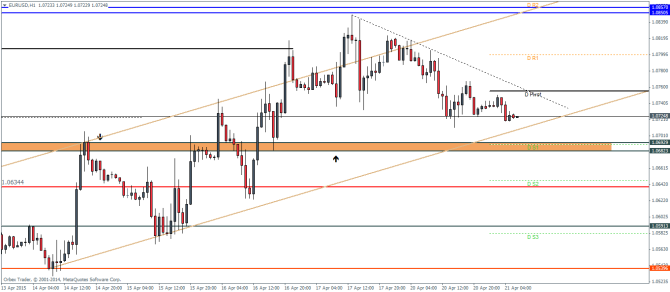

EURUSD Daily Pivots

| R3 | 1.0908 |

| R2 | 1.0864 |

| R1 | 1.0799 |

| Pivot | 1.0755 |

| S1 | 1.069 |

| S2 | 1.0646 |

| S3 | 1.0582 |

Failure to move any higher has seen the EURUSD drift lower for the most part yesterday. As noted previously, EURUSD could now test the support levels near 1.0693 thrugh 1.0683 levels, which will be the next important level to watch to ascertain the short term bias. A break of the support could see further declines in store towards 1.0642 and 1.06 levels, while a successful test of the support will see the EURUSD prepare for a move to the upside.

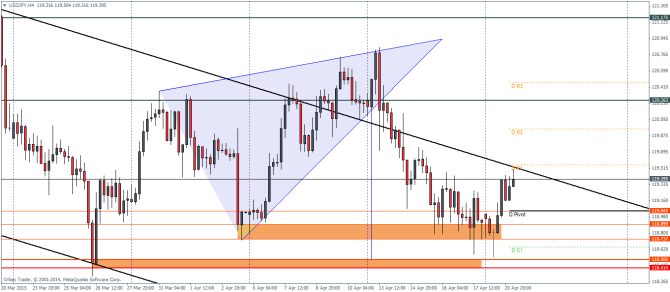

USDJPY Daily Pivots

| R3 | 120.454 |

| R2 | 119.942 |

| R1 | 119.554 |

| Pivot | 119.045 |

| S1 | 118.644 |

| S2 | 118.132 |

| S3 | 117.744 |

USDJPY dropped lower yesterday but saw a sharp reversal with the 4-hour doji candlestick pattern formed near the support levels of 118.89 through 118.73 levels. Price action turned around from this support to briefly test the upper trend line of the falling price channel. We suspect another test to the trend line before price eventually falls down to 118.5 levels. However, the move to the downside could be choppy as there are two major support levels near 118.9 – 118.737 and 118.5 – 118.4.

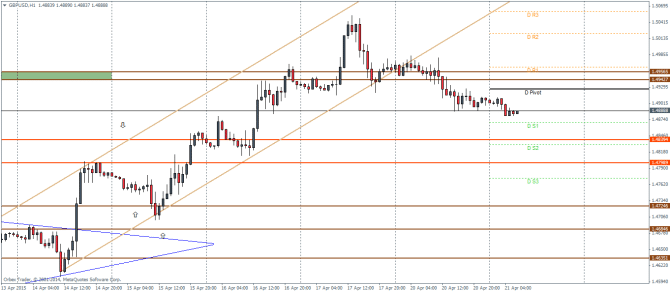

GBPUSD Daily Pivots

| R3 | 1.506 |

| R2 | 1.5022 |

| R1 | 1.4964 |

| Pivot | 1.4926 |

| S1 | 1.4869 |

| S2 | 1.483 |

| S3 | 1.4773 |

GBPUSD broke out from the rising price channel after making fresh highs towards 1.50 levels. The break of support near 1.495 – 1.494 is indicative of a move to the downside. The first support to test comes at 1.4839 followed by 1.479. A successful test of either of these two support levels will see GBPUSD rally back to retest the broken levels near 1.495 for test of resistance and a break above this could see GBPUSD post fresh highs above 1.50.