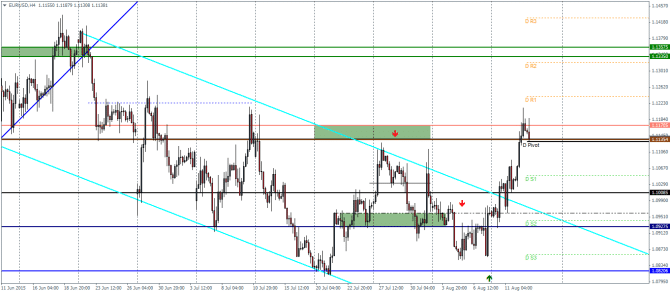

EURUSD Daily Pivots

| R3 | 1.1428 |

| R2 | 1.1320 |

| R1 | 1.1239 |

| Pivot | 1.1131 |

| S1 | 1.1048 |

| S2 | 1.0941 |

| S3 | 1.0859 |

EURUSD (1.1): EURUSD has finally reached the targeted resistance area between 1.117 and 1.11354. We expect to see a possibility of a decline to establish support somewhere close to 1.10 levels ahead of a continued rally to the upside. In the event that prices remains poised to the upside, support level could be established at the current resistance at 1.11705 – 1.1135 which could then pave way for a test of resistance to 1.1357 – 1.13350.

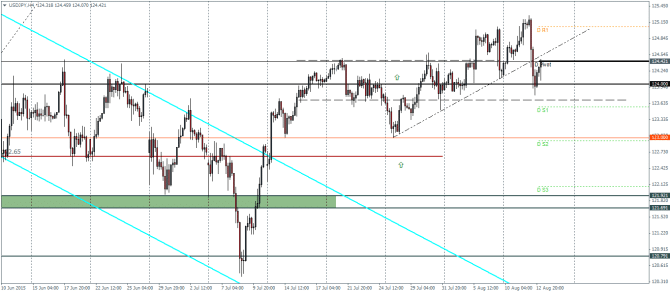

USDJPY Daily Pivots

| R3 | 126.547 |

| R2 | 125.912 |

| R1 | 125.064 |

| Pivot | 124.429 |

| S1 | 123.563 |

| S2 | 122.928 |

| S3 | 122.080 |

USDJPY (124.3): USDJPY has broken the trend line and the current retracement is being seen as a test of the trend line break out. If successful, USDJPY could decline back to 124 and eventually to 123.7 and to 123 main support. To the upside, a close back above the trend line could see USDJPY attempt to rally higher. However, the conviction of a downside move is based on the fact that the broken trend line along with the previous range high near 124.5 could act together as a strong resistance.

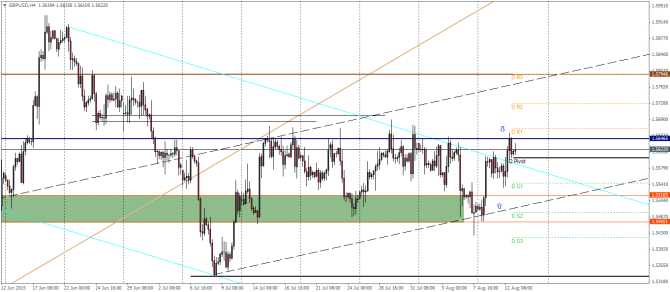

GBPUSD Daily Pivots

| R3 | 1.5795 |

| R2 | 1.5727 |

| R1 | 1.5669 |

| Pivot | 1.5601 |

| S1 | 1.5544 |

| S2 | 1.5476 |

| S3 | 1.5418 |

GBPUSD (1.56): GBPUSD has managed to stay above the main support above 1.5516 and attempted to break the resistance at 1.56465 yesterday but resulted in a close below the resistance. We expect to see another attempt to break this resistance which could pave way for further gains above 1.57. The next resistance on a potential break above 1.57 will see a rally to 1.58 with the likelihood that the resistance at 1.56465 could be briefly tested for support ahead of the rally. To the downside, as long as price is trading above 1.55165, we can expect the declines to be contained.