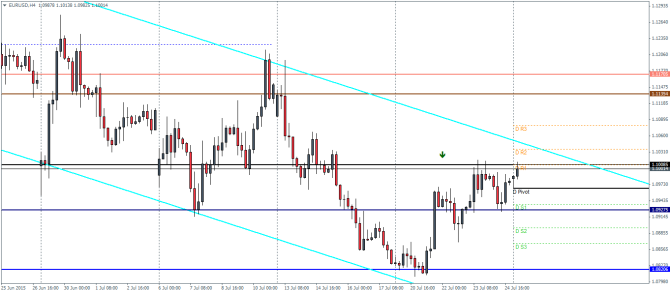

EURUSD Daily Pivots

| R3 | 1.1077 |

| R2 | 1.1036 |

| R1 | 1.1008 |

| Pivot | 1.0966 |

| S1 | 1.0937 |

| S2 | 1.0895 |

| S3 | 1.0866 |

EURUSD (1.10): EURUSD has maintained a strong short term bullish momentum after bounce off support near 1.0825. Price is currently struggling near resistance of 1.10. On the intraday charts, we see that this makes for a third attempt to break the resistance at 1.10. A retest to 1.09275 is very likely, but a risk of an upside breakout could see EURUSD break away from the falling price channel which will set the stage for a test to 1.1135 region of resistance. To the downside, a break below 1.09275 will see a test to the previous lows at 1.082.

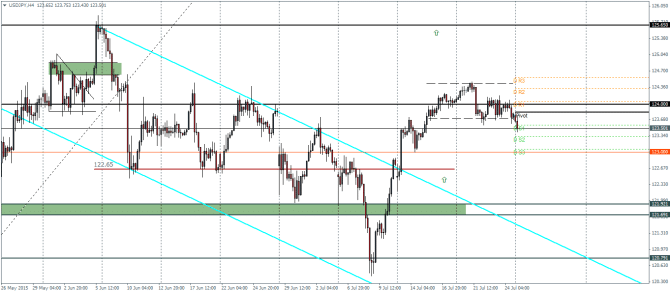

USDJPY Daily Pivots

| R3 | 124.562 |

| R2 | 124.325 |

| R1 | 124.056 |

| Pivot | 123.83 |

| S1 | 123.561 |

| S2 | 123.324 |

| S3 | 123.066 |

USDJPY (123.5): USDJPY has been declining after forming a bearish engulfing on July 21st. The current declines could see price fall to 123 support which marks the break out of the bull flag. On the intraday charts, there is a support near 123 through 122.65 region, which is where we expect USDJPY to resume its rally. However, resistance at 124 region needs to be cleared in order to aim for 125.65 resistance. A break below 122.65 could see a test back to the main support at 121.92 through 121.7..

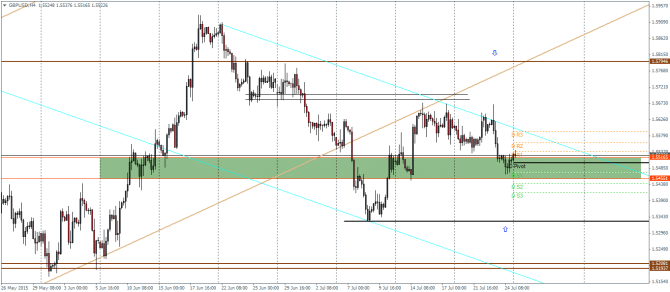

GBPUSD Daily Pivots

| R3 | 1.5591 |

| R2 | 1.5586 |

| R1 | 1.5532 |

| Pivot | 1.5499 |

| S1 | 1.5472 |

| S2 | 1.5439 |

| S3 | 1.5414 |

GBPUSD (1.552): GBPUSD closed Friday’s session on a small bodied candlestick pattern which comes right after a strong bearish session on Thursday. The appearance of this pattern near the daily support at 1.552 is indicative of a short term reversal. However, failure to bounce off the support here could see GBPUSD decline to the lower support at 1.533. On the intraday charts, price is currently trading in the support zone and we could therefore expect to see some sideways price action. The view for GBPUSD remains bearish for a test down to 1.533 support that was formed in early July. But there is also a risk of a break out to the upside, which will see GBPUSD break the falling price channel, in which case a retest to the current support at 1.552 could see a rally towards 1.58.