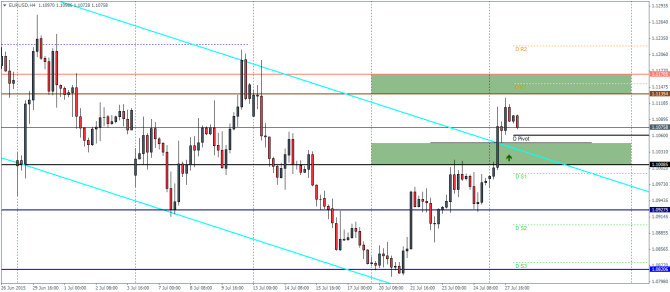

EURUSD Daily Pivots

| R3 | 1.1313 |

| R2 | 1.1221 |

| R1 | 1.1153 |

| Pivot | 1.106 |

| S1 | 1.0993 |

| S2 | 1.0899 |

| S3 | 1.0832 |

EURUSD (1.107): With EURUSD closing on a bullish note yesterday, we expect further upside to prevail. Prices have broken the falling price channel and a possible retest of the break out is very likely towards 1.1047 through the main support at 1.10. A successful test of support here could see EURUSD rally higher towards 1.1135 through 1.117 region of resistance. In the unlikely event that the support at 1.10 fails, EURUSD could decline back into the falling price channel with 1.09275 and 1.1082 being the next levels of support.

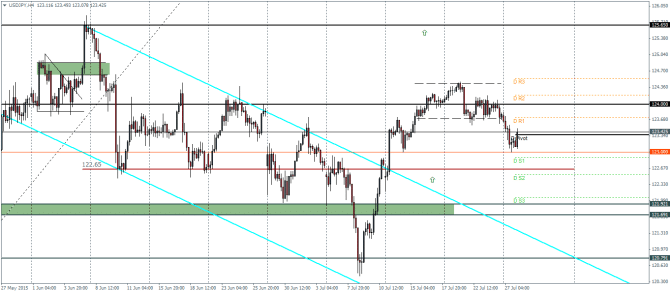

USDJPY Daily Pivots

| R3 | 124.539 |

| R2 | 124.19 |

| R1 | 123.718 |

| Pivot | 123.359 |

| S1 | 122.887 |

| S2 | 122.528 |

| S3 | 122.056 |

USDJPY (123.4): USDJPY is showing signs of reversal just a few pips above the break out zone from the falling price channel. We suspect that this short term upside momentum will be short lived as a test to 123 – 122.65 is required in order to establish support to target 124. An alternative scenario is that the current bounce could retest the range break out to 123.7 before declining to the lower support levels at 123 and 122.65

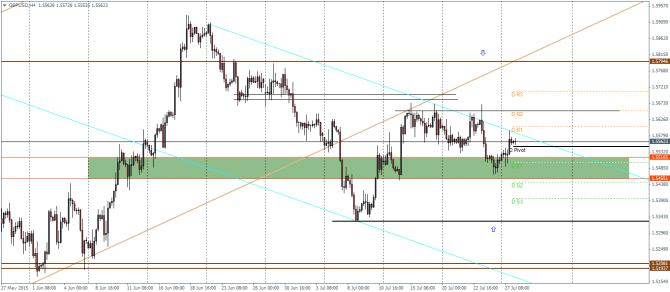

GBPUSD Daily Pivots

| R3 | 1.5708 |

| R2 | 1.5651 |

| R1 | 1.5605 |

| Pivot | 1.5547 |

| S1 | 1.5501 |

| S2 | 1.5444 |

| S3 | 1.5397 |

GBPUSD (1.556): GBPUSD has been trading flat for the most part and we anticipate a break out soon. Price action has been firmly testing the support zone near 1.551 through 1.5455, which indicates a possible break out to the upside towards 1.579 but price will need to clear the minor overhead resistance at 1.5651. In the unlikely event that support gives way, GBPUSD could find support near 1.533, the previous lows.