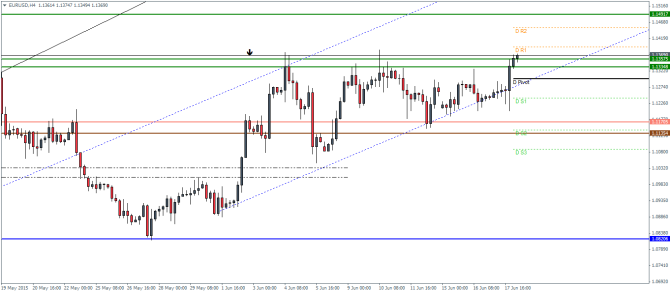

EURUSD Daily Pivots

| R3 | 1.1547 |

| R2 | 1.1451 |

| R1 | 1.1393 |

| Pivot | 1.1298 |

| S1 | 1.1241 |

| S2 | 1.1145 |

| S3 | 1.1088 |

EURUSD (1.136): EURUSD formed a bullish engulfing yesterday and managed to break across the 1.12845 level of resistance paving way for a test to 1.149. On the intraday charts also, we notice that EURUSD closed above 1.13575 resistance clearing the path for a test to 1.149 resistance. We expect a potential decline to the freshly broken resistance for support which could cement the rally to 1.148. With price trading within the price channel and having formed support near the lower end of the price channel, the risks for a break out are starting to diminish. However, establishing support at 1.13575 is essential in the rally to 1.149.

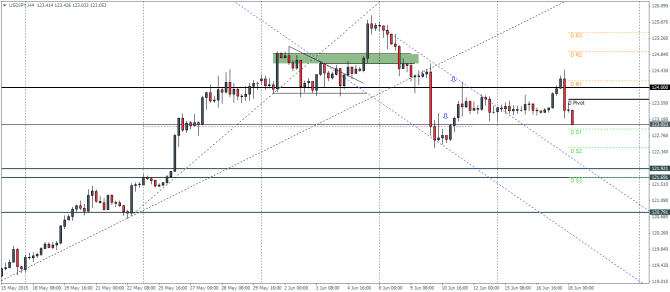

USDJPY Daily Pivots

| R3 | 125.417 |

| R2 | 124.925 |

| R1 | 124.168 |

| Pivot | 123.688 |

| S1 | 122931 |

| S2 | 122.451 |

| S3 | 121.697 |

USDJPY (123.075): USDJPY saw a rally that attempted to break above 124 level of resistance, but failure to break above resistance has sent the currency lower. We now expect USDJPY to eventually decline to 122 – 121.7 region to test for support. If this is successful, USDJPY could see some sideways price action. A break below 121.7 would however see USDJPY decline to fresh lows of 120.8.

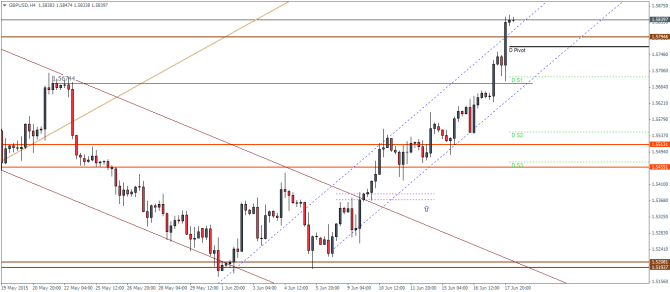

GBPUSD Daily Pivots

| R3 | 1.613 |

| R2 | 1.5989 |

| R1 | 1.5911 |

| Pivot | 1.5766 |

| S1 | 1.5688 |

| S2 | 1.5545 |

| S3 | 1.5467 |

GBPUSD (1.584): GBPUSD was very bullish yesterday and price closed above 1.57252 posting a fresh monthly high. The next resistance comes at 1.59. On the intraday charts, the break above the resistance at 1.579 is indicative of potential gains higher. We do expect a retest towads 1.579 ahead of the next leg in the rally. A break above 1.59 will see a test to 1.63. Overall, the price action in GBPUSD is likely to point to a rally that could see the currency retrace most of the losses from last year.