The euro and the yen certainly had their share of volatility within the global shake up.

Here are new forecasts on EURUSD and USDJPY from Credit Suisse:

Here is their view, courtesy of eFXnews:

1- Last week our economists revised their forecast for the first Fed rate hike, pushing it back to December, from September originally (Further delay is likely).

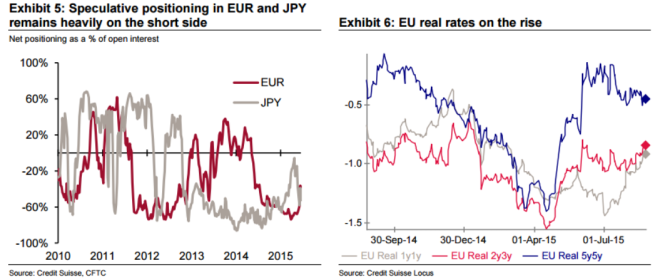

2- In the meanwhile, volatility in global risk markets has picked up sharply, on the back of the rout in local equity prices in China, despite local authorities’ efforts to stop the decline. While this has triggered USD strength against EM currencies, it has taken a toll on the dollar against the EUR and JPY.

3- From an FX perspective, the main implication of these two developments is that we upgrade the outlook for the EUR and JPY relative to our previous expectations.

4- The key question then becomes what will be the reaction function of the ECB and BoJ to stronger currencies, or at least the market’s perception of how timely and how energetic these will be. We retain a bias towards expecting action from the ECB at some point to reverse EUR strength, for example by announcing an extension beyond September 2016 of its current bond buying program. Nevertheless to acknowledge the higher probability that this becomes apparent in months rather than weeks, we have an above-consensus 3-month EURUSD forecast and a below-consensus 12-month one.

5- As for USDJPY, it is worth noting that consensus expectations are still very high. We are not so confident that the political will to use the JPY as a stimulus tool for ever more is as powerful as such expectations may be pricing in. But at the same time, we suspect the market will continue to draw a line under JPY weakness with an eye on the fact that the BOJ has promised sharp inflation gains from Q4 2015 onwards and could end up with egg on its face if it doesn’t act again. This hope should keep USDJPY above 120 over the medium term, even if it doesn’t make new highs.

CS revises up its EUR/USD profile to 1.10 in 3m and 1.00 in 12m (1.05, 0.98 prior), while pushing its USD/JPY profile down to 122 in 3m and 125 in 12m (128, 130 prior).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.