The euro certainly fulfills its role as a safe haven / funding currency, rising when the going gets tough. However, it’s important to remember that the moves are still limited, and choppy, to say the least.

The obvious reason is the tension towards the decision of the ECB, but this isn’t the sole reason.

Mario Draghi and his colleagues could err to the side of caution after doing more in December (more but not meeting expectations they had created). In March, they will have new forecasts to deal with.

But perhaps there is another factor creeping in: global currency wars.

- BOE Governor Mark Carney went all dovish, hurting the pound quite badly. He certainly expressed worries and said it isn’t a good time to raise rates.

- Commodity currencies are free-falling with a cut expected from Canada due to oil prices. The Australian dollar is at support and the kiwi is suffering a weak inflation report and a fall in milk prices.

- China remains a primary source of worry, whether one believes the GDP numbers or not.

- And what about the United States?

The Fed made its historic rate hike in December and seemed to be on path to hike again in March. Fed members remain silent ahead of their decision on January 27th but markets are certainly pushing back on rate hike expectations, with 60% chances against a hike. US inflation numbers are next.

So, if the ECB does not up its game by warning of action in March, it may find itself losing the precious little achievements the euro-zone economies enjoyed by having a lower euro for longer.

Are markets already cautious ahead of a cautious ECB? Is Draghi about to down the euro just to keep up?

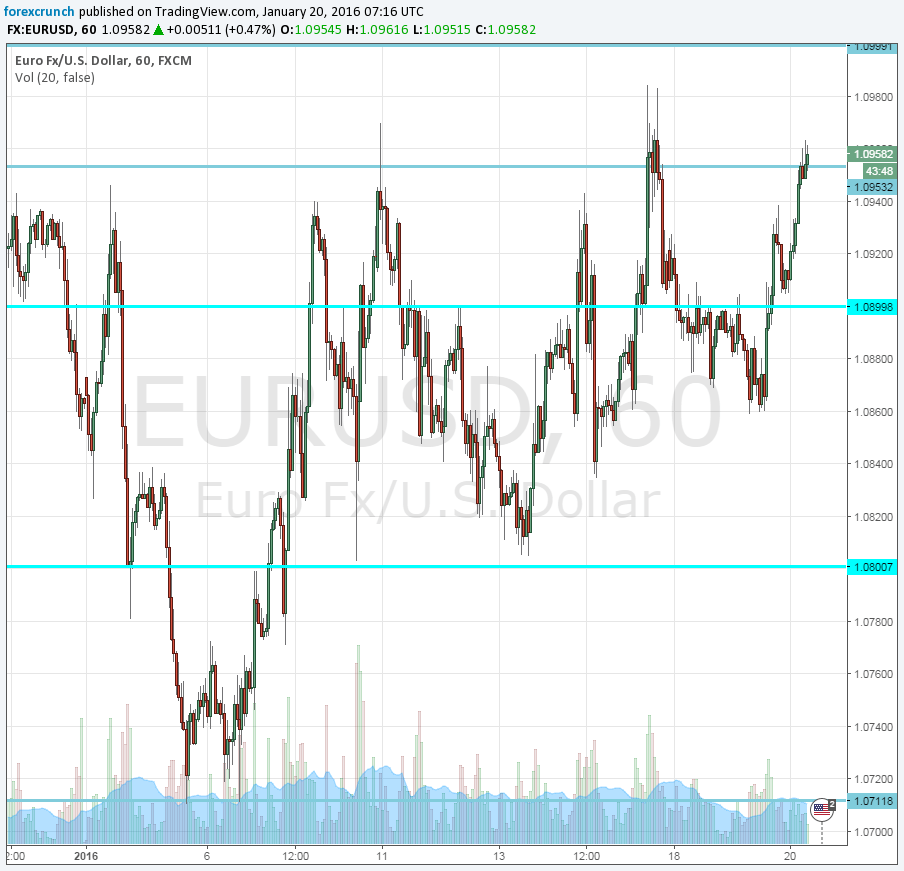

EUR/USD is battling 1.0950, at the top of the range, but a move towards 1.10, despite the proximity, looks very hard to achieve.

More:

- Will Draghi Down the euro this time around?

- Buy EUR/USD Targeting 1.13 – Morgan Stanley Trade Of The Week