Buy high and sell much higher, or sell low and cover much lower. Such phrases are the bread and butter of breakout traders. However, this can end in a false break too often.

A false break is quite frustrating for traders that are stalking a breakout. They enter the trade in the direction of the breakout only to see the pair return back to the range, burning their money.It doesn’t have to be that way. A false breakout can be an excellent trading opportunity, if you have the patience.

A false break is a small move, that could be followed by bigger moves:

- A second, convincing break: an initial dip lower or peek higher triggers the opposite reaction from those waiting to take a profit. However, if the forces behind the move are strong enough, a second move might not find the same resistance anymore.

- A pullback deep into the range: After testing the extremes a bit too much, the pair can reverse and return towards the middle of the range.

How can you determine where the pair will move next? This depends a lot on what’s going on in the markets. In the first case, the move is justified, but only ran into stops. In the second case, it was a false alarm.

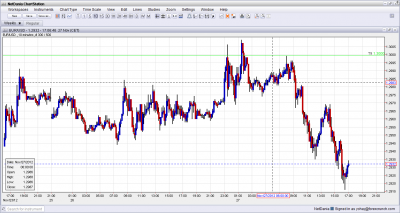

Example: EUR/USD broke above 1.30 on news that the Eurogroup reached an agreement on Greece. However, this was a half baked decision with many details awaiting discussion. So, after an unconvincing move above 1.30, the pair dropped below this line and later continued down in a rather one-sided move down to 1.2924.

Where would the Stop Loss / Take Profit points be?

As a general rule of thumb, the 15% rule can be used. This results in a risk/reward ratio of 30:70, or 1:2.33.

In case of a second, real breakout, enter the trade at 15% out of the range after a false break, place the stop loss point 15% into the range and the take profit at 85% above the range.

For example, if the range was calculated by yourself as 1.28 to 1.3 (200 pips), this rule would yield an entry at 1.3030, SL at 1.2970 and TP at 1.3170.

In case of a false break that results in a return to range, enter the trade at 15% back into the range after a false break, the SL at 15% out of the range and the TP at 85% deep into the range.

In the example of 1.28 to 1.30, the entry would be at 1.2970, SL at 1.3030 and TP at 1.2830.

These are only examples and not trade recommendations.

What do you think? Do you trade false breaks?

Further reading: 5 Most Predictable Currency Pairs