The Fed said its word. The dovish perception led to a slide in the greenback, sending GBP/USD to new highs and EUR/USD to challenge the double top.

When will the Fed hike and what level will rates hit by year end? The team at Dankse analyzes what the inner circle thinks:

Here is their view, courtesy of eFXnews:

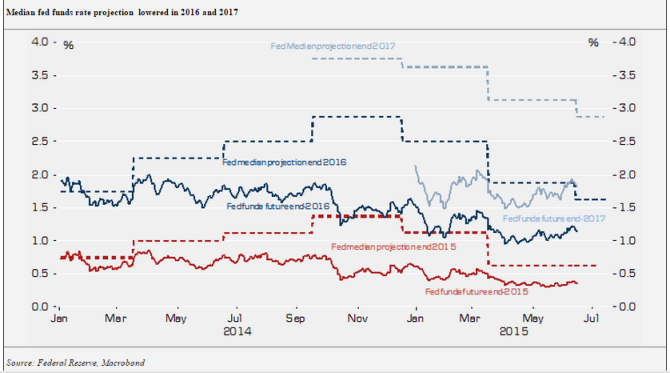

Information coming out of the June FOMC meeting was generally more dovish than we had expected. The dot plot showed the median projection for the fed funds rate end 2015 was unchanged at 0.625% but this masks a tilt towards just one rate hike for the most influential members of the FOMC.

There are now seven members expecting only one hike or less this year compared to three in March. Importantly, the five seeing one hike this year are likely voting members of the FOMC and is likely to include both Yellen and Dudley. Hence, to get a first hike in September the current positive momentum in data need to continue in the coming months, as the inner circle of the FOMC is currently tilting towards waiting to December (although the one hike could also refer to September). The median fed funds rate projection for 2016 and 2017 was revised down by 25bp which leaves the median pace of hikes in 2016 at 100bp and 125bp in 2017. There was very little change to the longer-term fed funds rate projections, and the median remains at 3.75%.

The FOMC took down the GDP growth projections in 2015 to 1.9% q4/q4 which is in line with our expectation for the year and the unemployment rate for Q4 this year was revised up to 5.2-5.3% from 5.0-5.2% in March. In the press conference, Yellen indicated that slower progress in the reduction of the unemployment rate in the FOMC forecast was largely due to an expected pick up in labour productivity. Apart from this, FOMC projections were little changed and there were no revision to the longer-run projection for GDP growth, inflation or unemployment.

Turning to the statement, the language on the current state of the economy was more positive than in April, reflecting the recent run of positive data. “Activity expanded moderately” compared to “slowed”, “pace of job gains picked up” compared to “moderated”, “underutilization of labor resources diminished somewhat” compare to “was little changed” and “household spending has been moderate and the housing sector has shown some improvement”. However, the forward looking part of the statement was essentially unchanged compared to April, so really not much information here. We had expected Yellen to use a more hawkish language at the press conference in order to prepare markets for an upcoming rate hike, there was not much in her comments that suggested an imminent rate hike. This supports our analysis above, that Yellen is likely among the five members projecting just one hike this year.

Generally the message was that the FOMC will need to see more decisive evidence that a moderate pace of economic growth will be sustained. So the conditions in the labor market will continue to improve and inflation will move back to 2%. And the mantra that when the hiking cycle starts, it will be slow was also repeated. In other words, although policy will be data dependent economic conditions are currently anticipated to evolve in a manner that will warrant only gradual increases in the target federal funds rate.

Overall, the sum of information leaves us with the impression that upcoming data will need to surprise on the upside compared to Yellen’s expectations to get a first hike in September. While our current GDP growth forecast for 2015 is in line with the FOMC projection, we believe that the unemployment rate will drop faster than the Fed is projecting and we also see wage inflation picking up pace in the second half of the year. In particular the latter is in our view likely to put a September rate hike back on the table and we continue to see two rate hikes this year as the most likely outcome but it is a close call.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.