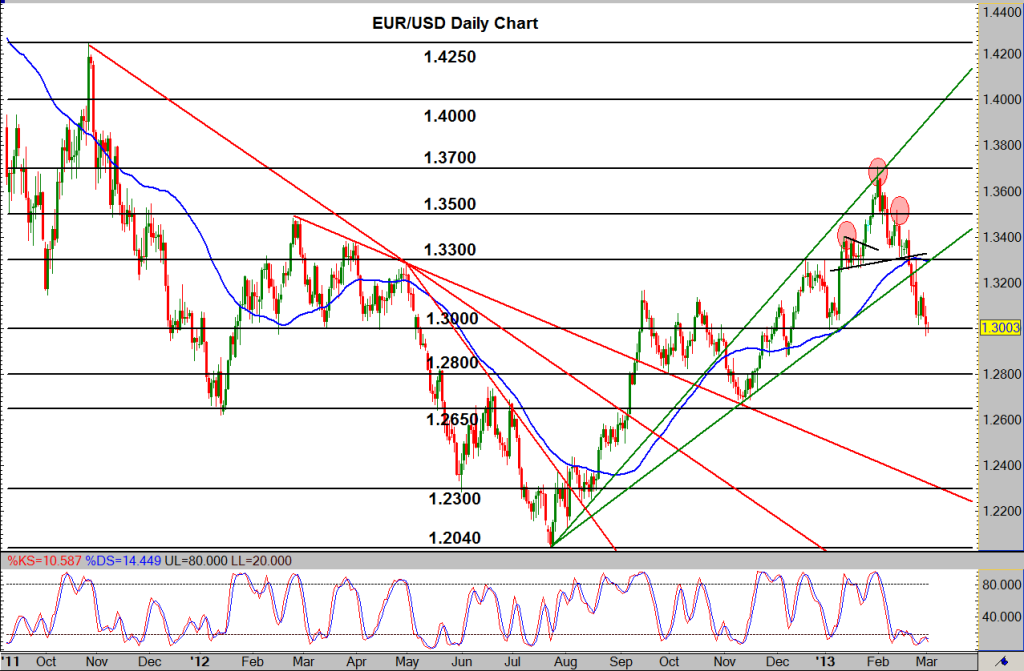

EUR/USD (daily chart) as of March 4, 2013 has fallen to hit a major downside support target around 1.3000, which has been one of its key bearish objectives since the breakdown of the previous half-year uptrend that occurred in late February. This breakdown was triggered off of a major head-and-shoulders reversal pattern that brought price tumbling down from its early February high around the 1.3700 resistance handle, to break down below strong 1.3300 support and ultimately hit 1.3000 on Friday. Incidentally, GBP/USD has also hit its downside target of 1.5000 after an exceptionally steep bearish trend.

Currently stalled around 1.3000 support, EUR/USD continues to be in strong bearish mode after the trend-changing turn to the downside within the past month. With the head-and-shoulders price target close to being fulfilled, a further significant push below 1.3000 support would confirm a downtrend continuation and clear the way towards further downside objectives around 1.2800 and then 1.2650.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.