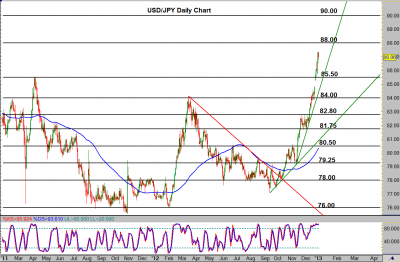

USD/JPY (daily chart) has continued its bullish bias into 2013 after having spent the last three months in a steep, stair-step ascent that broke out above many key resistance levels. After its breakout above 82.80 in mid-December, the pair went on to rise above 84.00 and then 85.50 in late December before pushing even further to hit a high well above 87.00 on the first trading day of 2013, establishing a 29-month high in the process. Although price has pulled back today, and further bearish retracements could potentially be forthcoming, the trend momentum has been steeply and consistently bullish. With key potential resistance to the upside around the 88.00 level, which was last valid throughout 2010, a breakout above that level could move higher towards the psychologically important 90.00 level. A bearish correction on the current bullish over-extension could find strong potential support once again around the 85.50 level.

James Chen, CMT

Chief Technical Strategist

FX Solutions

Forex trading involves a substantial risk of loss and is not suitable for all investors. FX Solutions LLC (“FXS”) is compensated through a portion of the bid/ask spread. This information is being provided only for general market commentary (based on technical analysis) and does not constitute investment trading advice. Certain information contained herein has been obtained from sources that FXS believes to be reliable; however, FXS cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is subject to change without notice. FXS has no obligation to update any or all of such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy or accept responsibility for errors. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision. Past performance is not necessarily indicative of future results. No determination has been made regarding the appropriateness of any information contained herein. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated herein. FXS expressly disclaims any loss or profits that may arise from any use of the information contained in or derived from this commentary. FXS and its affiliates may engage in transactions that are inconsistent with the views expressed herein. FXS does not endorse nor is it responsible for any third-party posts related to this material.