Idea of the Day

There are two interesting and diverging trends in Europe. Both the ECB and Bank of England announced various forms of “forward guidance” in the middle of the year, promising to keep rates low for a long time. Both are unravelling in very different ways, with the pressure on the ECB to lower rates (or more likely offer alternative policy prescriptions) whilst the Bank of England has continued to see firmer than expected data undermining the view that rates could be steady for a further two years. This has played out well on EURGBP so far this month, which has fallen nearly 2%. This is the biggest one week fall since March of this year. Policy action, or hints thereof, from the ECB this week could well see this trend enhanced, with the early October lows of 0.83327 in focus.

Data/Event Risks

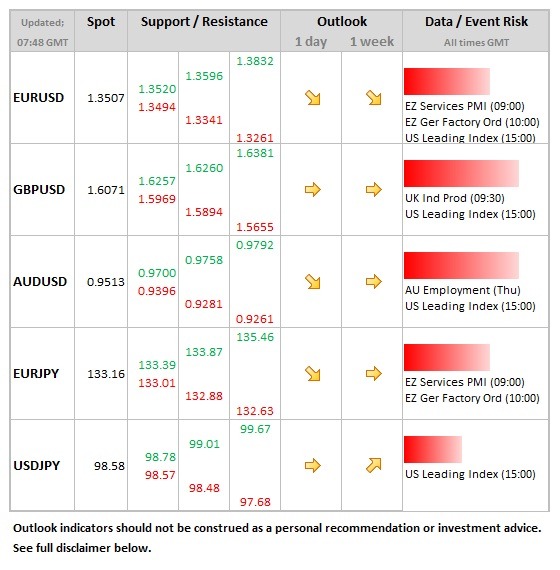

GBP: Industrial production data was on the weak side in August, with a modest bounce-back of 0.6% MoM after the 1.1% decline seen previously. Sterling would certainly welcome a stronger reading, which would help sterling achieve a stronger foothold above the 1.60 level.

Latest FX News

EUR: The single currency seeing some recovery during the Asia session, spending most of it above the 1.35 level on a general weaker dollar tone.

GBP: As we’ve mentioned before, sterling really struggling for air above the 1.60 area, but the stronger than expected services PMI data for September allowed for a push towards 1.61. The Bank’s forward guidance on rates is looking increasingly fragile.

AUD: Trade balance was better than expected, allowing a small push higher in the Aussie. Data showed downward revision to August number, with September at AUD -284mln. So far, push back above the 0.9500 level sustained, but remains lower vs. level seen just ahead of RBA statement.

Further reading: