Stock markets are certainly in a sour mood and this has implications for the already fast moving currency markets. Here is the analysis from Morgan Stanley:

Here is their view, courtesy of eFXnews:

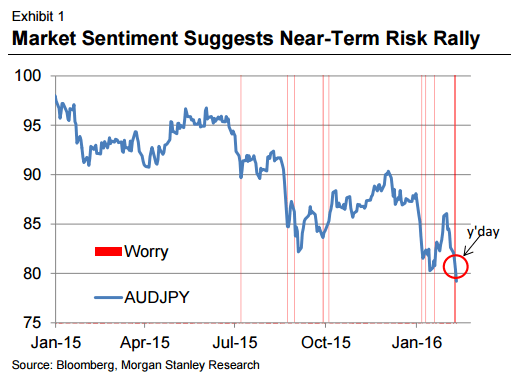

Morgan Stanley believes the FX market has reached a level of ‘worry’ that could mark a near-term turning point.

“Given the pace of the risk selloff over recent weeks, market participants who were feeling mark-to-market pain were asking almost daily when things would turn around. The seemingly one-way decline couldn’t last forever. But asset prices kept dropping.

However, in the middle of this week, the FX markets took an even sharper turn lower. Such environments we have found typically mark near-term turning points,” MS argues.

Temporary Rally Supported by Central Banks:

“However, our reasons for a possible risk rally aren’t only technical. We expect central banks to respond to the recent sharp market moves, with the BoJ first on our list. Should the BoJ respond with new policy measures, the recent fall in pressure,” MS projects.

Medium Term Unchanged:

“However, our medium-term views remain the same. One of the reasons we believe any near-term bounce in risk markets would be an indication to sell is because the marginal utility of incremental easing by central banks is diminishing quickly.

This could be exemplified no better than by the BoJ’s experience with the JPY over the last week. Following BoJ cutting rates into negative territory, we maintained our view for further JPY strength. However, the pace of strength has surprised even our bullish expectations,” MS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.