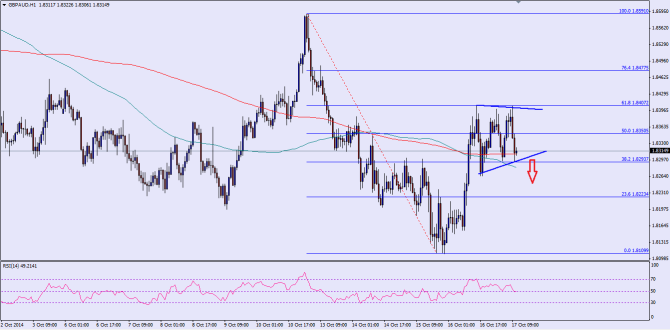

The British pound recently traded higher against the Australian dollar after setting a short-term low at 1.8109. Currently, it is consolidating in a range and somehow forming a breakout pattern. There is no economic release in the UK, and that is the reason why we might witness more range trading in GBPAUD. However, it looks like setting up for a break in the short term and waiting for a catalyst for the same. The Asian session was quiet comparatively, but the Japanese yen was a mover as it traded lower against the US dollar and the Euro.

There is an important contracting triangle formed on the hourly chart of the GBPAUD pair, which might act as a catalyst for a break in the pair. The pair recently traded close to the 61.8% fib retracement level of the last leg from the 1.8591 high to 1.8109 low. So, this particular failure could be significant and might ignite a bearish move in the pair. There is a bullish sign as well on the charts, as the pair is trading above the 100 and 200 hourly moving averages. Both the moving averages are coinciding with the triangle support area, which increases the importance of 1.8300 area. If the pair breaks the mentioned support area, then it would ignite more losses in the pair moving ahead.

There is even a chance that the pair might bounce substantially from the highlighted support area. There is no denial that the risk of a break is more, but the pair could blast higher as well.

Overall, one might consider selling with a break below the mentioned support area.

————————————-

Posted By Simon Ji of IKOFX