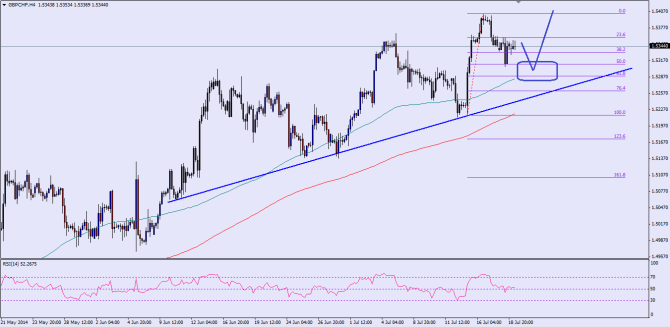

The British pound suffered some losses against the US dollar and the Swiss franc during this past week, but later it managed to bounce back from the important support levels. The GBPCHF pair fell towards the 1.5300 support level after setting a short-term high at 1.5403 level. The pair managed to find buyers around the mentioned support area and currently climbing higher.

This particular bounce came from a very technical level i.e. the 50% fib retracement level of the last move higher from the 1.5216 low to 1.5403 high. So, this can be considered as a significant level for a bounce back.

However, the follow through after the bounce was not convincing, which has left the door open for one more leg lower in the short term. There is a bullish trend line on the 4 hour chart for the pair, which might act as a catalyst for the pair in the coming sessions. In addition, there are few more critical support levels that could act as a barrier for sellers.

Initially, the 50% fib level, then the 61.8% fib and finally the 100 moving average on the 4 hour chart might provide support to the pair. So, the 1.5290-70 area is a key support zone for the pair, and it might bounce again from here if it moves lower from the current levels.

It is also possible that the pair might not fall from the current levels. In that situation, initial resistance can be seen around the swing high of 1.5360. If the British pound buyers manage to pierce the same, then a test of the 1.5400 handle is possible in the short term.

Posted By Simon Ji of IKOFX