The purchasing managers’ index for the UK’s manufacturing sector disappointed quite badly in February: it dropped from 50.8 to 47.9 points, well below expectations for a rise to 51 points. A score below 50 represents contraction.

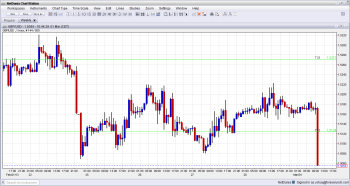

GBP/USD took the news quite badly, falling over a 100 pips and breaking below the previous low of 1.5069 to print a new low of 1.5055 before bouncing. Update: Also 1.5050 is lost and 1.5040 is the new low.

Analysis: All hands on deck – rough waters ahead for the pound

The manufacturing sector enjoyed only two months above the 50 point mark. The services sector is certainly larger than the manufacturing sector, but it is still of importance. The weaker pound hasn’t helped the manufacturing sector too much.

Support appears at 1.5050 before the very round number of 1.50. Resistance is at 1.5124, but this is only week resistance. 1.5220 is another cap before 1.5270.

For more lines, see the GBPUSD forecast.

This is how it looks on the weekly chart:

The pound has been under a lot of pressure during February, and this pressure continues into March. Will the BOE announce more QE next week?

Other UK figures also came out worse than expected: Net Lending to Individuals stood only 0.6 billion, considerably less than 1.1 that was expected. Mortgage Approvals stood on 55K, a bit below 57K that was predicted and only the M4 Money Supply figure exceeded expectations by rising 0.9% instead of 0.3%.