Cable advanced quite nicely but hit a high and began retreating, mostly due to the strength of the pound. What’s next for cable?

The team at Goldman Sachs provides a technical analysis for GBP/USD:

Here is their view, courtesy of eFXnews:

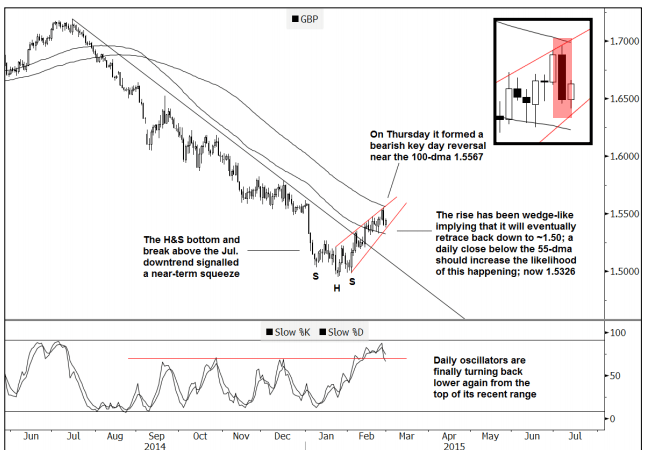

GBP/USD had a false break lower into the end of last week but ultimately still looks wedge-like and therefore corrective, notes Goldman Sachs.

“The entire move since the Jan. 23rd looks corrective/counter-trend. Furthermore, a bearish key day reversal formed last Thursday’s test of the 100-dma,” GS adds.

“Wedges often reverse the full extent of their moves so in this case, the market should eventually return to ~1.50. A daily close below the 55-dma (now at 1.5326) will increase the likelihood of this happening,” GS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.