GBP/USD was marked by volatility last week and posted gains of about 100 points. The pair closed the week at the 1.52 line. It’s a busy week, with 12 events on the schedule. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

In the US, key releases were satisfactory, led by retail sales and inflation numbers which met expectations late in the week. Expectations of a rate hike at the all important Fed policy meeting have been priced in by the markets, which allowed for a consolidation of the US dollar and gains by cable.

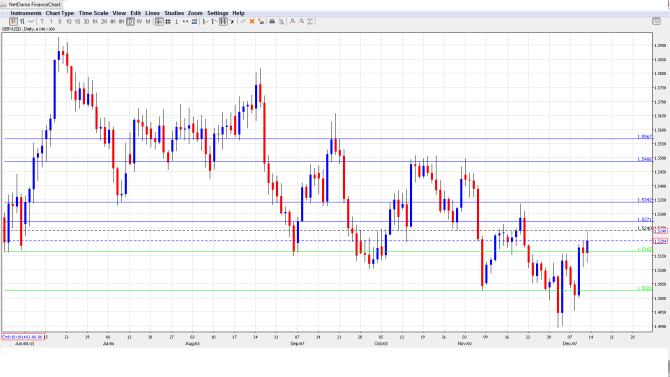

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. This housing price index provides a snapshot of the level of activity in the UK housing sector. The indicator disappointed in October, posting a decline of -1.3%.

- MPC Member Nemat Shafik Speaks: Monday, 11:00. Shafik will speak at an event in London. A speech that is more hawkish than expected is bullish for the pound.

- CPI: Tuesday, 8:30. CPI is the primary gauge of consumer inflation, and any unexpected reading can result in sharp movement from GBP/USD. The index has struggled, failing to post a gain in the past three months. The estimate for the November reading stands at +0.1%.

- MPC Member Andy Haldane Speaks: Tuesday, 8:30. Haldane will deliver remarks at an event in London. The markets will be listening closely, looking for hints as to possible future monetary moves by the BOE.

- PPI Input: Tuesday, 8:30. PPI Input measures inflation in the manufacturing sector. The index posted a small gain of 0.2% in October, matching the forecast. The markets are braced for a sharp downward turn in November, with an estimate of -1.0%.

- RPI: Tuesday, 8:30. RPI is an important consumer inflation indicator but excludes housing costs, which tend to be volatile. The index slipped to 0.7% in October, indicative of weak inflation levels in the UK. The indicator is expected to improve to 0.9% in November.

- BOE Quarterly Output: Tuesday, 11:00. This report provides details of monetary policy operations and market analysis. It is considered a minor event since parts of the bulletin have already been released.

- CB Leading Index: Tuesday, 13:30. The index has struggled, posting just one gain in the past five readings. The September reading came in at -0.3%. Will we see an improvement in the October report?

- Average Earnings Index: Wednesday, 8:30. This key event is a leading indicator of consumer inflation. The indicator has been steady, posting two straight gains of 3.0%. The markets are expecting a softer gain in October, with an estimate of 2.5%.

- Claimant Count Change: Wednesday, 8:30.This is one of the most important indicators, and an unexpected reading can quickly impact on the movement of GBP/USD. The indicator has posted three straight gains, beating the estimate on each occasion. A weak gain of 0.9 thousand is expected in the November release. The unemployment rate is expected to remain at 5,3% in November.

- Retail Sales: Thursday, 8:30. Retail Sales is the primary gauge of consumer spending and should be treated as a market-mover. The indicator disappointed with a reading of -0.6% in October, worse than the forecast of -0.4%. However, much better news is expected in the November report, with an estimate of +0.6%.

- CBI Industrial Order Expectations: Thursday, 10:00. This indicator continues to post weak readings, and came in at -11 points in November, which was within expectations. The forecast for the December release stands at -9 points.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.5109 and dropped to a low of 1.4956. The pair then reversed directions and climbed to 1.5240, as resistance held firm at 1.5269 (discussed last week). The pair closed the week at 1.5204.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

1.5567 was an important cap in last September and early October.

1.5485 was tested in the first week of November but has since strengthened as the pair trades at lower levels.

1.5341 is next.

1.5269 was a cap in November and is an immediate resistance line.

1.5163 as switched to a support role as the pound posted strong gains.

1.5026 has strengthened as a support line.

1.4856 has remained intact since April.

1.4752 is the final support level for now.

I am neutral on GBP/USD.

With a historic rate hike widely expected next week in the US, the dollar could see some gains as a result of the magnitude of the event. At the same time, the pound could hold its own or even continue to rally if key numbers such as UK job data beats expectations.

Our latest podcast is title Get Ahead of the Fed

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.