GBP/USD rebounded last week, posting gains of about 70 points. The pair closed the week at the 1.51 line. It’s a busy week, with 14 events on the schedule. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

Federal Reserve chair Janet Yellen provided broad hints that the Fed will raise rates next week, as she took note of the strong job market numbers and didn’t sound concerned about persistently weak inflation. The critical NFP came in above expectations, but both PMI reports disappointed. In the UK, Services PMI beat the forecast, but the Manufacturing and Construction PMIs both fell short of expectations.

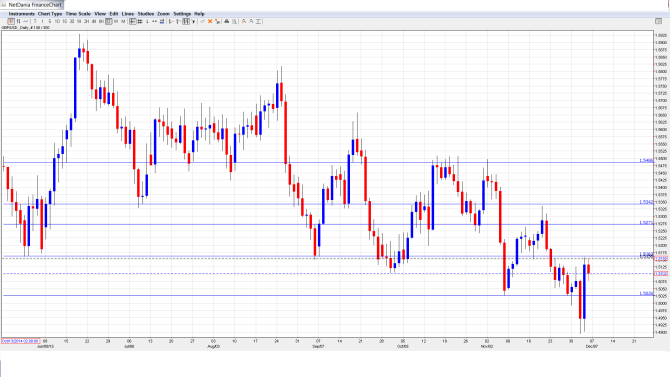

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Halifax HPI: Monday, 7th-8th. This housing price index provides a snapshot of the level of activity in the UK housing sector. The indicator bounced back in October with a strong gain of 1.1%, beating the forecast of 0.7%. The markets are expecting a much smaller gain in November, with an estimate of 0.3%.

- BOE Governor Mark Carney Speaks: Monday, 15:00. Carney will speak at an event in London. The markets will be looking for clues as to possible future moves by the BOC.

- BRC Retail Sales Monitor: Tuesday, 00:01. This indicator measures the change in retail sales in BRC stores. The indicator has struggled, posting two declines in the past three readings.

- Manufacturing Production: Tuesday, 9:30. This is the first key reading of the week, and should be treated as a market-mover. The indicator improved to 0.8% in September, easily beating the forecast of 0.4%. This was the highest gain since February 2014. The markets are bracing for a downturn in the October report, with an estimate of -0.1%.

- 30-year Bond Auction: Tuesday, Tentative. The average yield on 30-year bonds slipped to 2.45% in September, marking a 3-month low. Will the downward trend continue in the upcoming auction?

- NIESR GDP Estimate: Tuesday, 15:00. Analysts rely on this monthly indicator to help predict the trend of GDP, which is released once a quarter. The indicator edged up to 0.6% in the November reading, after two consecutive gains of 0.5%.

- FPC Meeting Minutes: Wednesday, 10:30. This minor event provides details of the Financial Policy Committee’s most recent meeting, and may provide insights into the BOE’s view of the economy and financial conditions. The minutes are released each quarter.

- RICS House Price Balance: Thursday, 00:01. This indicator is based on a survey of property surveyors. In October, the index improved to 49%, above the estimate of 45%. The forecast for the November report stands at 47%.

- Trade Balance: Thursday, 9:30. The UK trade deficit narrowed in September to GBP 9.4 billion, better than the estimate of GBP 10. 7 billion. This follows two consecutive deficits of GBP 11.1 billion. The deficit is expected to widen in October, with an estimate of GBP 9.8 billion.

- Monetary Policy Summary: Thursday, 12:00.

- Official Bank Rate: Thursday, 12:00. The BOE is expected to hold the benchmark interest rate at 0.50%. The central bank will also release the vote on the November rate decision, which is expected to remain at 8 members in favor of holding the current rate level, and one member in favor of raising rates.

- Asset Purchase Facility: Thursday, 12:00. The BOE is expected to hold QE at 375 billion pounds. The vote of the previous QE decision will also be released. It is expected to remain unanimous, with all 9 members voting in favor of maintaining the current level.

- Construction Output: Friday, 9:30. The indicator has posted mostly declines in 2015, pointing to weakness in the construction industry. In September, the indicator came in at -0.2%, well short of the forecast of +1.5%. The markets are expecting a much brighter October, with an estimate of 1.1%.

- MPC Member Martin Weale Speaks: Friday, 15:35. Weale will speak at an event in London. A speech which is more hawkish than expected is bullish for the British pound.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.5037 and dropped to a low of 1.4894, marking a 7-month low. The pair then reversed directions and climbed to 1.5158, as resistance held firm at 1.5163 (discussed last week). The pair closed the week at 1.5102.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

1.5485 was tested in the first week of November but has since strengthened as the pair trades at lower levels.

1.5341 is next.

1.5269 was a cap in November.

1.5163 held firm last week as the pair posted gains.

1.5026 was tested and is an immediate support level.

1.4856 has remained intact since April.

1.4752 is the next support line.

1.4654 is the final support level for now.

I am neutral on GBP/USD.

Although a rate hike in the US is widely expected, this has been priced into the markets, so the dollar might not make any headway even if monetary divergence sharpens. The pound’s direction this week could depend on the market’s response to the BOE minutes and monetary decisions.

Our latest podcast is about Expectations and Disappointments in EUR, USD and Oil

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.