GBP/USD posted strong gains for a second straight week, as the pair climbed 150 points. GBP/USD closed the week at 1.4366. This week’s highlight is the Average Earnings Index Employment Change. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

UK Manufacturing Production impressed with a gain of 0.7%, much higher than expected. In the US, the only major release was Unemployment Claims, which dropped to 259 thousand. This beat the estimate of 272 thousand.

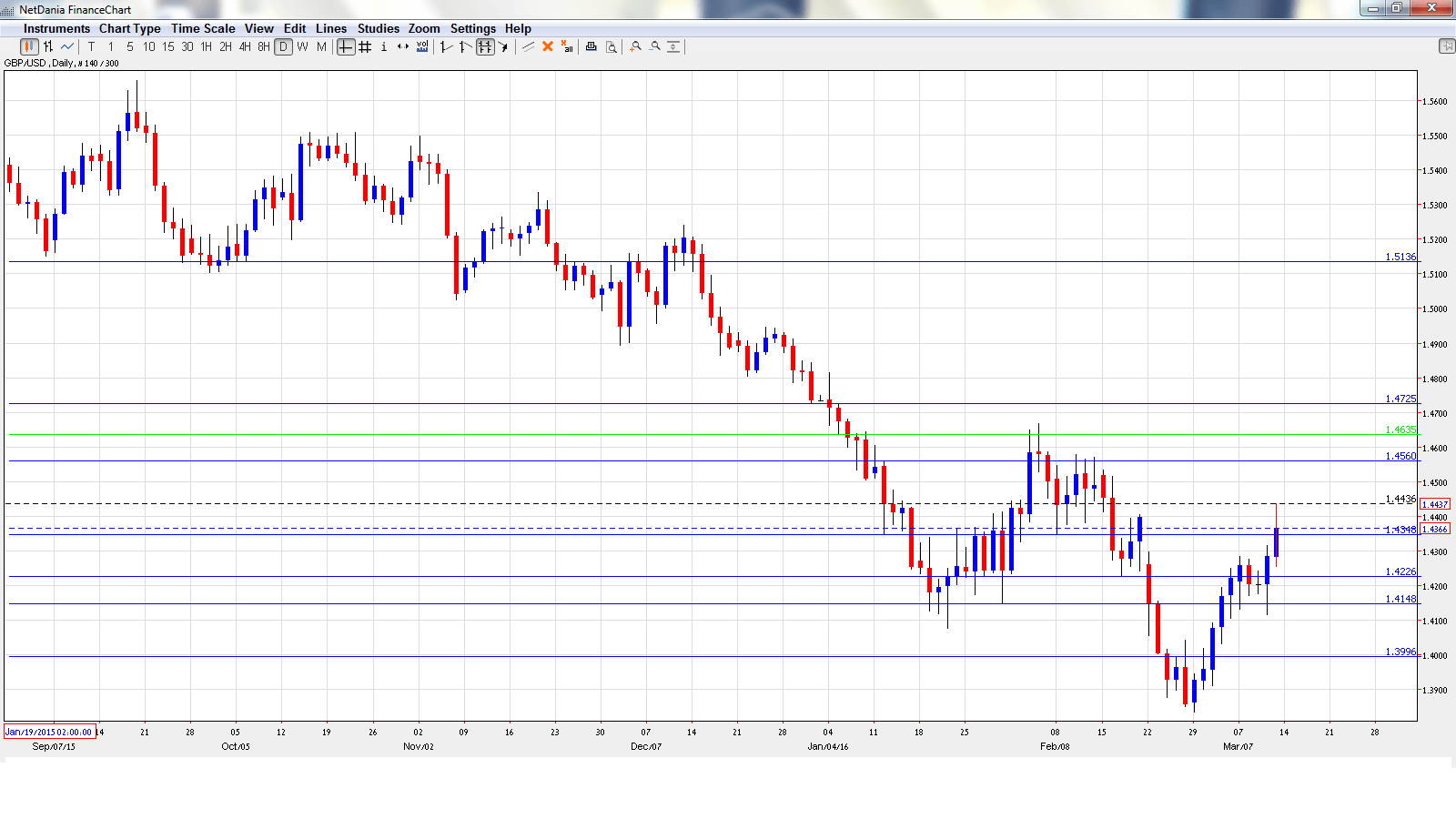

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Average Earnings Index: Wednesday, 9:30. This leading indicator of consumer inflation continues to lose ground, and dropped to 1.9% in December, matching the forecast. Little change is expected in the January report, with an estimate of 2.0%.

- Claimant Count Change: Wednesday, 9:30. The indicator impressed in January, with a reading of -14.8 thousand. This easily beat the estimate and marked the indicator’s sharpest decline since March 2015. The forecast for February stands at -9.0 thousand. The unemployment rate is expected to remain unchanged at 5.1%.

- Annual Budget Release: Wednesday, 12:30. The markets will be keeping a close eye on the annual budget. Unexpected spending or revenue figures can have a significant impact on the movement of GBP/USD.

- CB Leading Index: Wednesday, 13:30. This indicator is based on 7 economic indicators. The December reading improved to 0.4%, its best showing since April 2015.

- Official Bank Rate: Thursday, 12:00. The BOE is expected to hold the benchmark interest rate at 0.50%. There was a surprise in the February vote, as the markets had expected one member to vote in favor of a rate increase. However, all 9 members voted to maintain rates. Another unanimous vote is expected in the March decision.

- Asset Purchase Facility: The BOE is expected to hold its QE program at 375 billion pounds/year. Previous votes have been unanimous and no change is expected in the March decision.

- Monetary Policy Summary: Thursday, 12:00. The markets will be combing through this report, looking for clues as to the BOE’s future monetary policy.

- BOE Quarterly Bulletin: Friday, 12:00. This event is unlikely to have much effect on GBP/USD, since much of the report has already been released.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.4210. The pair dropped to low of 1.4116 late in the week, testing support at 1.4148 (discussed last week). The pair then reversed ground, climbing to a high of 1.4436. GBP/USD pair closed the week at 1.4366.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

We begin with resistance at 1.4725.

1.4635 has been a resistance line since early February.

1.4562 is next.

1.4346 has switched to support. GBP/USD is trading just above this line as we start the new trading week.

1.4227 remains busy and has switched to a support level.

1.4148 was a cushion in late January. It was tested last week as the pound posted sharp losses before recovering.

The round number of 1.40 is next. It was last breached in March 2009.

1.3901 is the final support line for now.

I am bearish on GBP/USD.

The dollar has been broadly lower in March, and the pound has taken full advantage. Will we see a correction this week due to profit taking? US fundamentals remain stronger than the UK, and although the Fed is unlikely to raise rates this week, the bias remains towards tightening. This monetary divergence favors the US dollar.

Our latest podcast is titled Digesting Draghi & Fired for the Fed

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.