GBP/USD was almost unchanged last week, as the pair closed slightly under the 1.52 line. This week’s key release is Second Estimate GDP. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

The highly-anticipated Federal Reserve minutes didn’t contain anything new, as the markets eye a possible rate hike in December. US Core Inflation met expectations, with a gain of 1.9%. In the UK, key releases were a disappointment. CPI posted a decline of 0.1% for a second straight month, and Retail Sales was awful, with a decline of 0.6%.

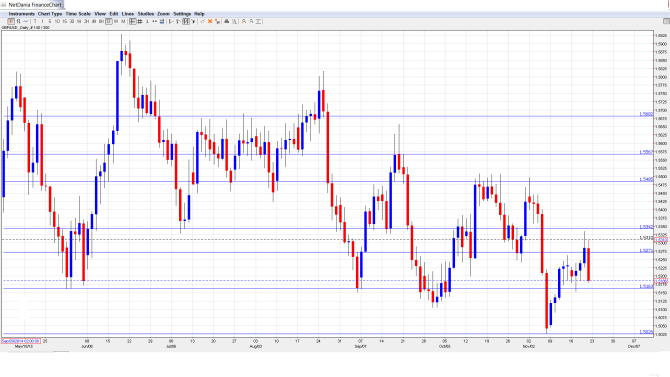

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CBI Realized Sales: Tuesday, 11:00. This event is a leading indicator of consumer spending, a key driver of economic growth. The indicator slipped to 19 points in October, well short of the estimate of 35 points. The markets are expecting an improvement in the November report, with an estimate of 25 points.

- BBA Mortgage Approvals: Wednesday, 9:30. This indicator provides a snapshot of the level of activity in the UK housing sector. In September, the indicator slipped to 44.5 points, short of the estimate of 46.2K. The markets are expecting a slight improvement in October, with a forecast of 45.5K.

- Autumn Forecast Statement: Wednesday, 12:30. The government will release this statement, which is considered an annual pre-budget report. The statement will include projected spending and borrowing levels as well as economic forecasts.

- GfK Consumer Confidence: Friday, 00:05. The indicator remains at low levels, and edged to just 2 points in October, shy of the estimate of 4 points. Another reading of 4 points is expected in the November report.

- Nationwide HPI: Friday, 27th-30th. The housing inflation indicator improved to 0.6% in October, above the estimate of 0.5%. This marked the indicator’s best showing in six months. Will the index post another gain in November?

- Second Estimate GDP: Friday, 9:30. GDP is a highly-anticipated event, and an unexpected reading can have an immediate effect on the movement of GDP/USD. Preliminary GDP slipped to 0.5% in Q2, shy of the estimate of 0.7%. The forecast for Second Estimate GDP in Q3 stands at 0.5%.

- Preliminary Business Investment: Friday, 9:30. Business Investment is an important indicator of confidence and spending in the business sector. The indicator surged 2.9% in Q2, surprising the markets which had expected a gain of 1.6%. This was the indicator’s highest gain since Q2 of 2012. The forecast for the Q3 report stands at 1.5%.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.5217 and touched a low of 1.5153, testing support at 1.5163 (discussed last week). The pair then reversed directions and climbed to a high of 1.5335. However, the pair was unable to consolidate these gains and closed the week at 1.5186.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

1.5682 was a key resistance line in December 2014 and January 2015. 1.5590 follows.

1.5567 was an important cap in September and October.

1.5485 was tested in the first week of November but has some breathing room as the pair trades close to the 1.52 line.

1.5341 is next.

1.5269 continues to be busy and held firm last week as the pair posted gains.

1.5163 was tested last week and is currently a weak support level. It could see more activity early in the week.

1.5026 is protecting the symbolic 1.50 level.

1.4856 has remained intact since April.

1.4752 is the final support level for now.

I am bearish on GBP/USD.

The guessing game over the Fed’s plans continues, as many analysts are predicting the Fed will make a rate move in December. This speculation is positive for the dollar. In the UK, weak inflation and retail sales numbers could make investors nervous and weigh on cable.

Our latest podcast is titled Between Terror and Thanksgiving:

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.