The US dollar outperformed recently not only against the currencies, but also against precious metals and commodities. GOLD was seen trading lower recently, and it looks like it might continue heading lower in the short term. It has breached an important support around the $1275 level, which might ignite more downsides.

Economically, there is no major release scheduled in the US today, so let’s see how the precious metal prices trade in the upcoming sessions. GOLD sellers look more aggressive, and they are unlikely to stop unless there is an event which gives buyers a reason to take the prices higher.

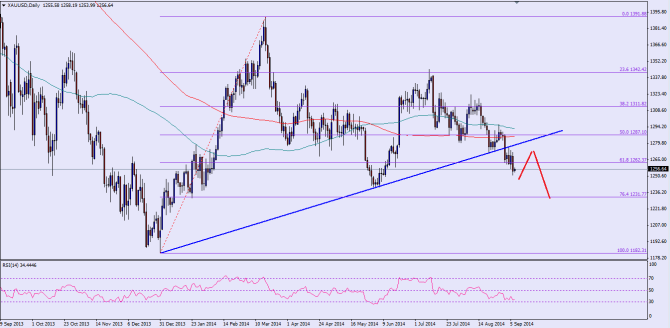

There was a monster bullish trend line on the daily chart of GOLD, which was breached during this past week. This particular break can be seen as very negative, as GOLD is now trading below the 50% fib retracement level of the last leg higher from the $1182 low to $1391 high. Moreover, it has also breached the 61.8% fib level, which could take the prices close to the previous low of $1182. The broken trend line acted as a hurdle for buyers once, and it is likely to act as a resistance in case GOLD tried to trade higher. The 100 and 200 daily moving averages are also sitting just around the $1285 level, which might act as a pivot zone for GOLD.

On the downside, initial support can be seen around the 76.4% fib level at $1231. Any further bearish momentum could take the prices of the yellow metal towards the last low of $1182.

Overall, selling close to the $1280-85 levels might be a good option, as long as the prices stay below the 100-day moving average.

————————————-

Posted By Simon Ji of IKOFX