GOLD after testing the $1270 support area managed to climb back higher and recently broke an important resistance area around $1280. GOLD managed to gain buyers lately as the economic releases in the US failed to match the expectation. It is likely aligning itself for more gains in the near term, and if the US dollar correct lowers then it might have one more reason to go higher moving ahead. There is no major release scheduled in the US today, which means GOLD might trade in a range or according to the FX market sentiment.

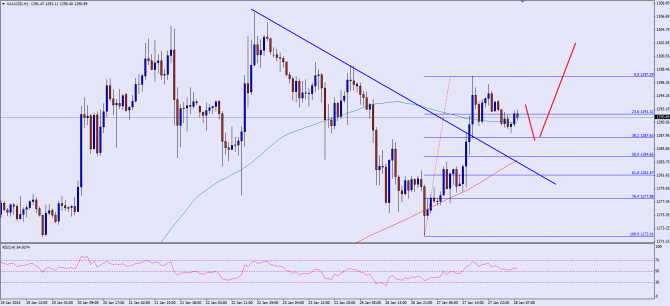

There was an important bearish trend line formed on the hourly chart of GOLD, which was recently breached and opened the doors for more gains in the near term. The most important point is that GOLD is now trading above the 100 and 200 hour moving averages. This might encourage buyers to take the prices higher. Any correction from the current levels could be seen as a buying opportunity. The broken trend line might act as a support, as the 200 hour simple moving average is also sitting around the same area. Moreover, the 50% fib retracement level of the last leg from the $1272 low to $1297 high is also around the same area. In short, there is a major support around the $1284-2 area.

On the upside, a break above the $1292 level might take GOLD towards the $1300 level where sellers are likely to defend more gains moving ahead.

Overall, one might consider buying dips GOLD as long as it is trading above the 200 MA.

————————————-

Posted By Simon Ji of IKOFX