The ECB decision is approaching and tension is certainly high. What’s priced in? How will it play out?

Here is the view from Goldman Sachs:

Here is their view, courtesy of eFXnews:

On the day of the last ECB meeting (October 22), Goldman Sachs projected that EUR/USD would go to 1.05 in the run-up to the December meeting.

As we are approaching that level, GS discuses what is now priced in EUR/USD, if there is scope for a dovish surprise on December 3, and how the pair will likely move on the day of the ECB meeting and going into the FOMC December meeting.

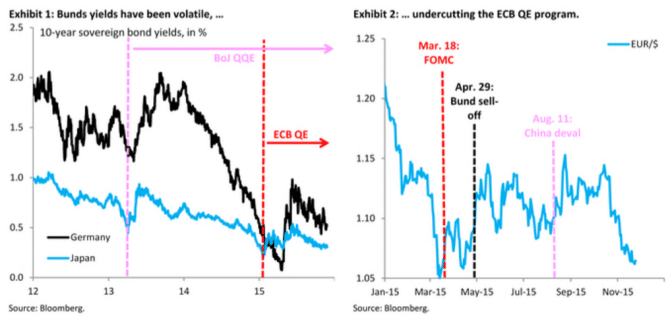

“The big picture is that ECB QE, since its announcement in January, has had a troubled history, with volatility in long-term Bund yields – the Euro zone safe-haven asset – far above that of JGB yields (Exhibit 1). That volatility has impaired a key transmission channel of QE, which is to push Euro zone investors into risk assets and thereby boost growth, and is in our minds the main reason why EUR/$ went back to 1.14 in May (Exhibit 2),” GS notes.

“This week’s ECB meeting is therefore more than just the usual policy decision. It is about fixing some of the damage from the summer and “doing it like you mean it”. We think that dimension is underappreciated and means that, together with the low risk appetite typical for this time of year, the hurdle is low for a dovish surprise on December 3,” GS adds.

“We continue to expect EUR/$ to head into the ECB at 1.05, drop 2-3 big figures on the day, and then fall to parity by end-December, aided by a Fed lift-off.

As risk-taking resumes in January, the divergence trade should pick up steam, with a possibility that our 12-month forecast of 0.95 for EUR/$ could be reached by end-Q1,” GS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.