- Grayscale manages $1.5 billion in digital assets for its clients, $1.38 billion of that is in BTC while $90 million is in ETC.

- The 23.6% Fib level support has to hold but if it gives in, ETC/USD will still be in danger of retesting $14.20 support.

Grayscale Investments is a company that manages cryptocurrency investments on behalf of its clients. It gives investors a way to enter the cryptocurrency space and particularly digital assets investments. The website explains:

“At Grayscale, we believe investors deserve an established, trusted, and accountable partner that can help them navigate digital currency investing. That’s why we are building transparent, familiar investment products that facilitate access to this burgeoning asset class, and provide the springboard to investing in the new digital currency-powered internet of money.”

The investments company said in a recent report that it currently holds at least $90 million investment in Ethereum Classic; the 13th largest crypto with a market capitalization of $1.5 billion according to CoinMarketCap. The firm currently manages at $1.5 billion, all in digital assets for its clients. At least $1.38 of the total holdings is in Bitcoin (BTC).

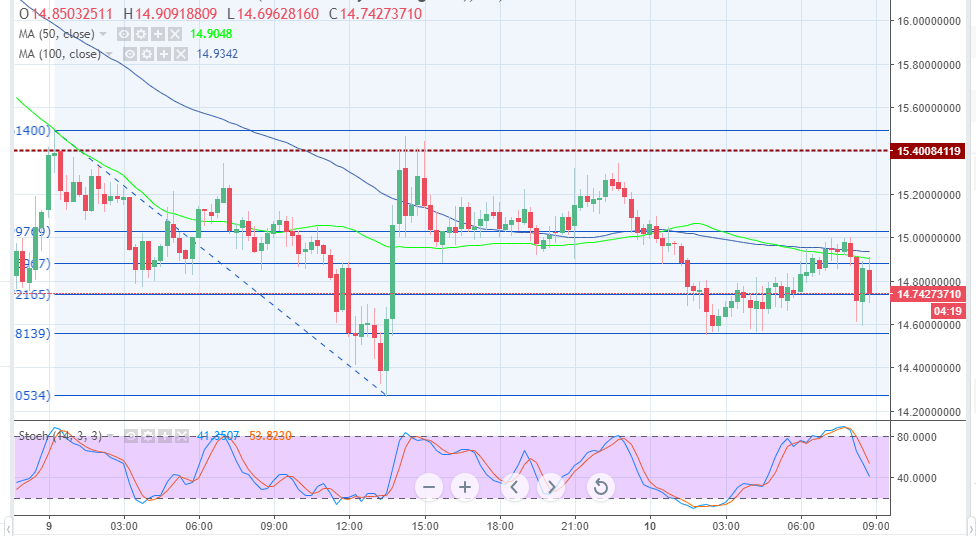

Ethereum Classic price analysis

Ethereum Classic corrected higher at the beginning of the week due to the hype surrounding the listing on Coinbase Pro and Coinbase Prime. However, the widespread selloff in the market did not spare the digital asset. It plunged from trading highs above $20.00 only to find a support at $14.20. On Thursday, a slight recovery gave it a boost from the pits but the upside remained capped at $15.40 as indicated on the chart.

Fresh subtle declines continued on Friday morning (Asian trading hours) but the support at the 23.6% Fib level taken between the highs of $15.49 and lows $14.81 at $14.56 prevented further declines. The price bounced back up from the support but has been unable to clear the $15.00 resistance. At the time of press, the trend is highly bearish with the stochastic making advances south. Moreover, the short-term 50 SMA has crossed below the longer-term 100 SMA to show that the sellers are regaining control. The above 23.6% Fib level support has to hold but if it gives in ETC/USD is in danger of retesting $14.20 support and slide below $14.00. On the upside, the price must find support above $15.00 before it can comfortably attack $15.40 again.

ETC/USD 15-minutes chart