Among the different types of technical traders, we can find two large groups: range traders and those stalking the breakouts. There is also a mix of both approaches.

In some cases, a breakout can prove to be a “fakeout” that provides a significant trading opportunity in the opposite direction. Here’s how it works, with a recent example on EUR/USD.

Range vs. Breakout

After a pair is capped or supported by a certain technical level and gets close to this level, range traders will try going in the opposite direction: buying the pair when it gets close to support or selling it when it gets close to resistance. A break out under support or above resistance will trigger breakout traders to ride on a sharp outwards move: sell the pair when it breaks support or buy it when it breaks resistance.

However, there are many cases of false breakouts. A pair dips below support but doesn’t go too far, or lifts its head above resistance without following through. Only a second attempt is the “real breakout” that breakout traders are waiting for.

The Big Rebound

Yet there are cases where the false breakout is immediately followed by a very strong rebound. One explanation for this move comes from the world of options: certain market participants have an interest in pushing the price to certain levels, triggering options such as barrier options, Double No Touch options and others. Other market participants want to avoid the same levels. These battles created interesting price action.

These moves aren’t backed by fundamentals and don’t represent any short term or long term trends – just interests by certain participants.

So, in such cases, some participants push the pair to a certain level, and after they won the battle, they let go. The result is that the fakeout is followed by a violent retracement.

Fakeout Example

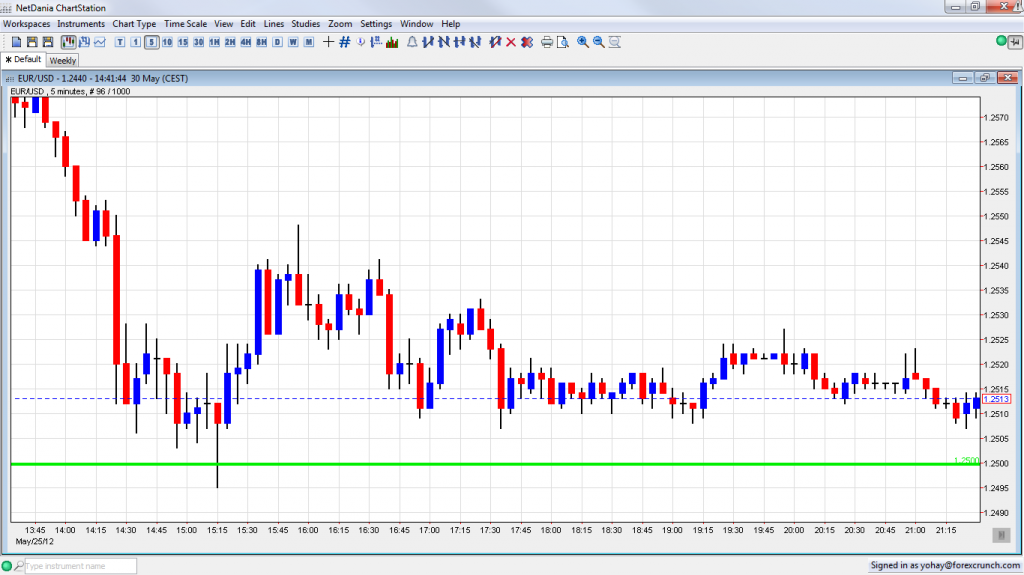

Such a move happened on Friday, May 25th with EURUSD. The pair slid towards the psychologically important level of 1.25. It suddenly dropped below this line and reached 1.2495. The pair was under 1.25 for only very few seconds. It then rose back up and climbed as high as 1.2547 in a gradual move.

So, the fakeout turned out to be a jumping board for a rebound – the move down was quick, but the rebound took more time.

So how can we trade this false breakout?

- Placing an order: One option is to place an order for the opposite direction just under the line in question and to go in the opposite direction. This is some kind of “extended range trading”.

- Stalking: Another option is to stalk this breakout, but instead of trading in the direction of the breakout, go for the range trading direction after seeing that the pair isn’t really breaking.

What do you think? Do you trade false breakouts?

Further reading: 5 Most Predictable Currency Pairs – Q2 2012