The Non-Farm Payrolls is the highlight of this week’s trading calendar. Here is the view from Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

Employment growth likely slowed in January with nonfarm payrolls rising by 170,000. This follows a robust 2015 finish, as jobs increased by an average of 284,000 in the final three months. Exceptionally favorable weather, particularly in December, provided a boost to the data. Our models suggest that there will be some payback in the following month and an even larger payback two months late. The major snowstorm that hit the East Coast won’t play a role in the January figures since it was after the survey week; it could matter for February, however. Outside of the weather, we see reasons for some weakening in the trend given the modest uptick in jobless claims and a minor drop in the Conference Board’s labor market differential.

On a sector basis, we think mining continued to shed jobs amid depreciating oil prices, and manufacturing was stagnant. Construction is particularly sensitive to weather and ramped up in 4Q, so there is a high risk of weakening. On the flip side, services sector jobs growth likely remained solid. We also look for government to rise by 5,000, which implies private sector job growth of 165,000.

We expect the unemployment rate to remain unchanged at 5.0%. Meanwhile, average hourly earnings should rise 0.3% mom with upside risk, following no gain in December. The base effects reverse between December and January. They were favorable in December, boosting the yoy rate to 2.5%, but even with a 0.3% mom increase this month, we would see deceleration to 2.2% yoy.

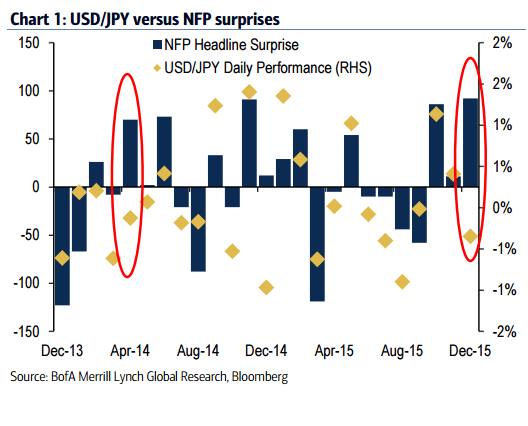

FX Trading Strategy: The inability of the dollar to rally on last month’s stellar 292k report leaves asymmetric risks for the USD (similar to rates) into this week’s NFP report, particularly with our below consensus call of 170k. Indeed, despite the largest NFP surprise since 2012, USD/JPY sold off by nearly a percent, something that hasn’t happened since April 2014 (Chart 1). As we have noted, this implies the market will continue to question the Fed’s ability to hike the 4 times the dots imply with the risks emanating from China (and lower commodity prices) front and center in investors’ minds. While the 6mma of payrolls growth is an above-trend 229k (enough to justify further hikes in the Fed’s mind), even a positive surprise is unlikely to assuage investors’ overall concerns about the U.S. economy.

Therefore, we see USD price action limited. However, a weak report, even if it leaves the trend of jobs growth above 200k, will likely weigh on risk sentiment. We favor being short the USD against perceived safe-haven currencies, like EUR and JPY, which according to our regression analysis have the most consistent responses to NFP surprises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.