- Litecoin is off the recent highs, losing 3% since the beginning of Wednesday.

- Coin’s creator explaines, why he is not going to buy back the Litecion.

Litecoin is changing hands at $61.25, off Tuesday’s high touched at $63.70. The coin has lost as much as 3% of its value since the beginning of Wednesday, though it is still 2.2% higher on a daily basis. The market value of the seventh largest coin settled at $3.5B, the average daily trading value is registered at $236M.

Charlie Lee, Litecoin’s creator and prominent cryptocurrency enthusiast, confirmed that he was not going to buy back the Litecoins he had sold some time ago. Speaking at CNBC, he explained that he wanted to avoid conflict of interest and fend off charges of Litecoin price manipulations. While his position is nothing new, some traders and industry players cannot share Lee’s view.

Lee remains optimistic about long-term Bitcoin and Litecoin perspectives saying that the price would go up from current levels, though it is hard to predict the timeline.

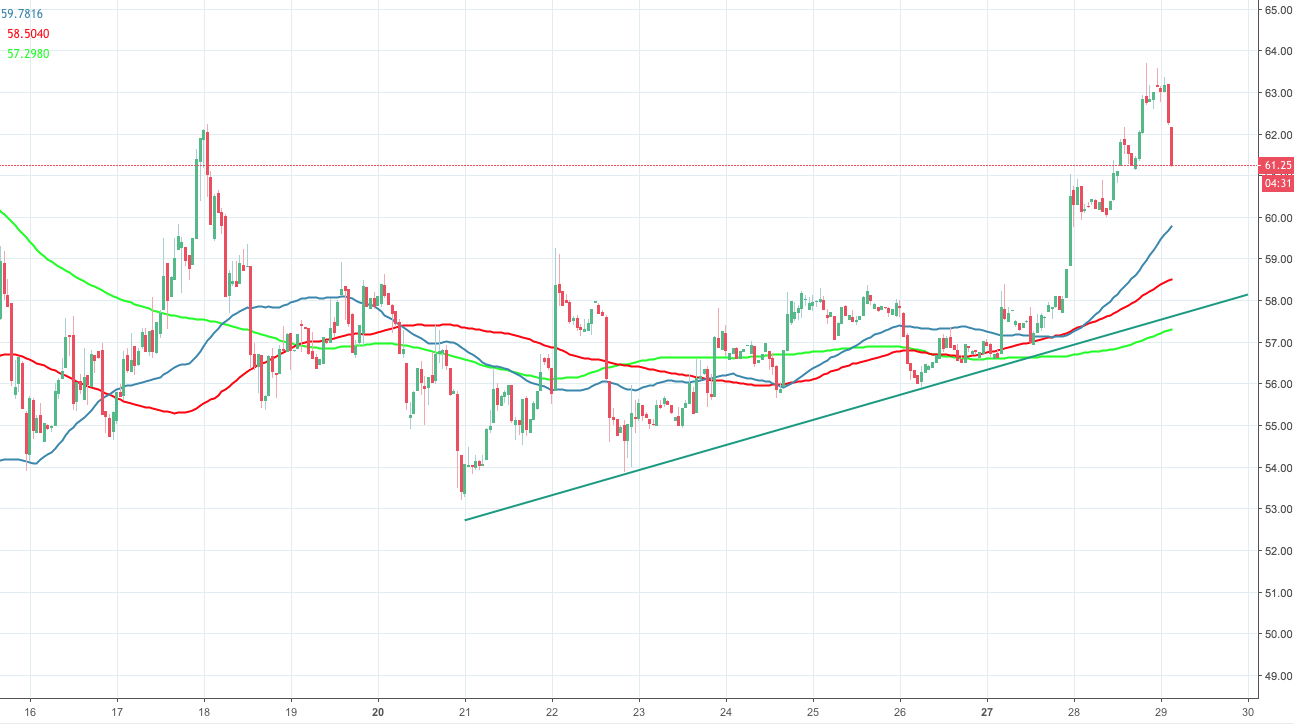

Litecoin’s technical picture

On the intraday level, as long as LTC/USD stays above $61.00 handle, there is a chance for renewd upside with the first aim at Tuesday’s high $63.70. Once this area is cleared, the bulls may push the price to $70.00 strengthened by DMA50.

On the downside, a sustainable movement below $61.00 will open up the way towards $60.00, followed by $59.87 (SMA50, 1-hour). The next barrier is created by SMA 100 (1-hour) at $58.53 and the short-term upside trendline (currently at $57.70).

LTC/USD, 1-hour chart